Contents:

Although job platforms and social networking sites work hard to combat fake listings, scammers consistently find new ways to bypass security measures. These fraudulent listings often go public, putting job seekers at serious risk.

We reviewed 2,670 posts and comments from individuals who shared their experiences with employment scams on social media platforms throughout 2023 and 2024, uncovering some intriguing trends.

We collected stories from LinkedIn, Facebook, and Reddit, where people raised alerts to prevent others from enduring similar experiences and sought advice from those who had gone through the same situation.

Our analysis focused on four dimensions:

- job specifics

- scam characteristics

- the financial and emotional impact on victims

- red flags and preventive measures.

Summary

Here is a summary of the most interesting results:

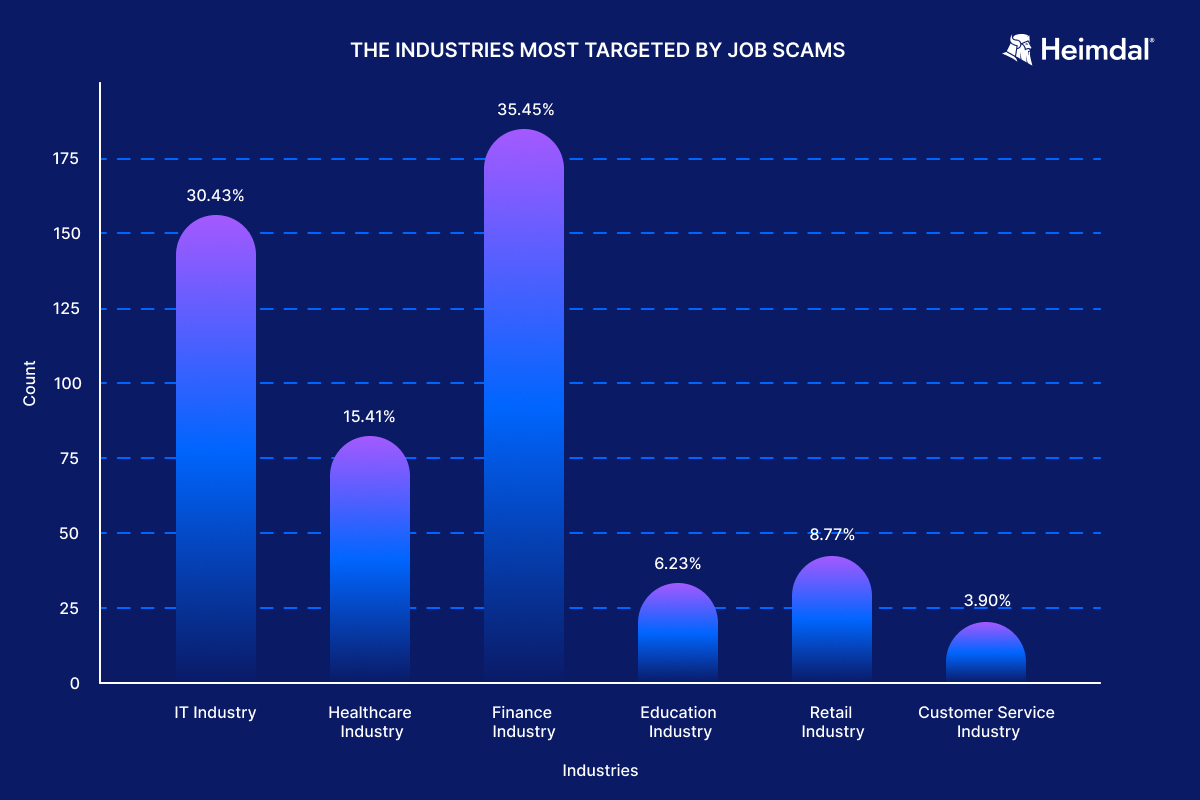

1.The finance industry accounts for 35.45% of job scams, followed by IT at 30.43%, healthcare with 15.41%, retail, education and customer service.

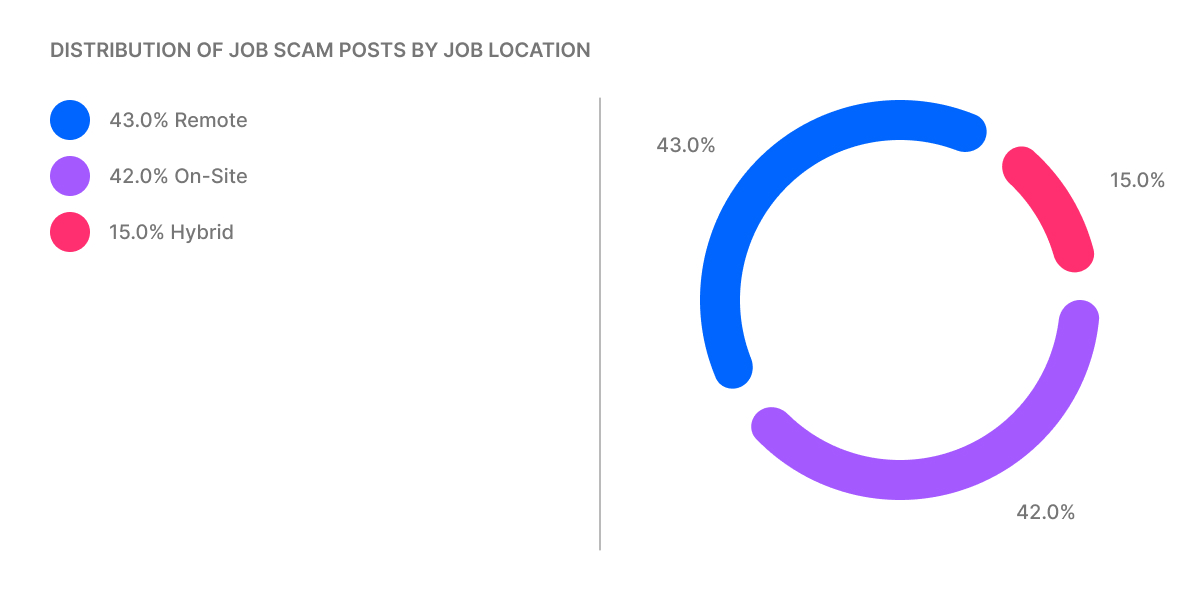

2. As for the location, 43% of the job scam posts mentioned remote positions, 42% were on-site, and 15% were hybrid.

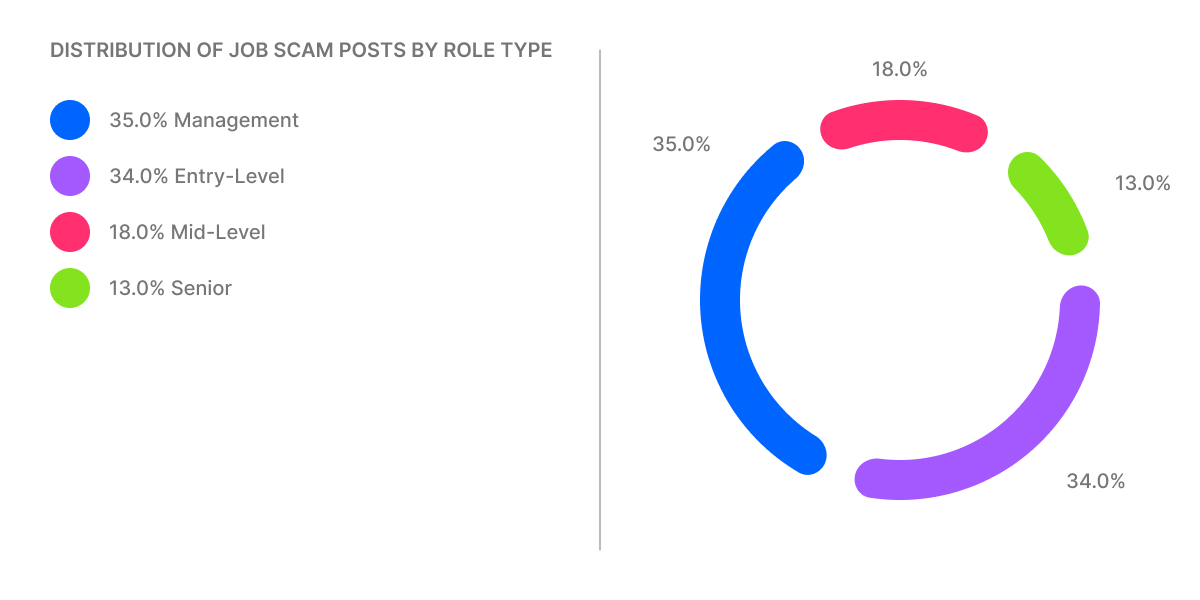

3. Most job scams target leading roles – managers (35%), followed by entry-level (34%), senior (13%) and mid-level roles (18%).

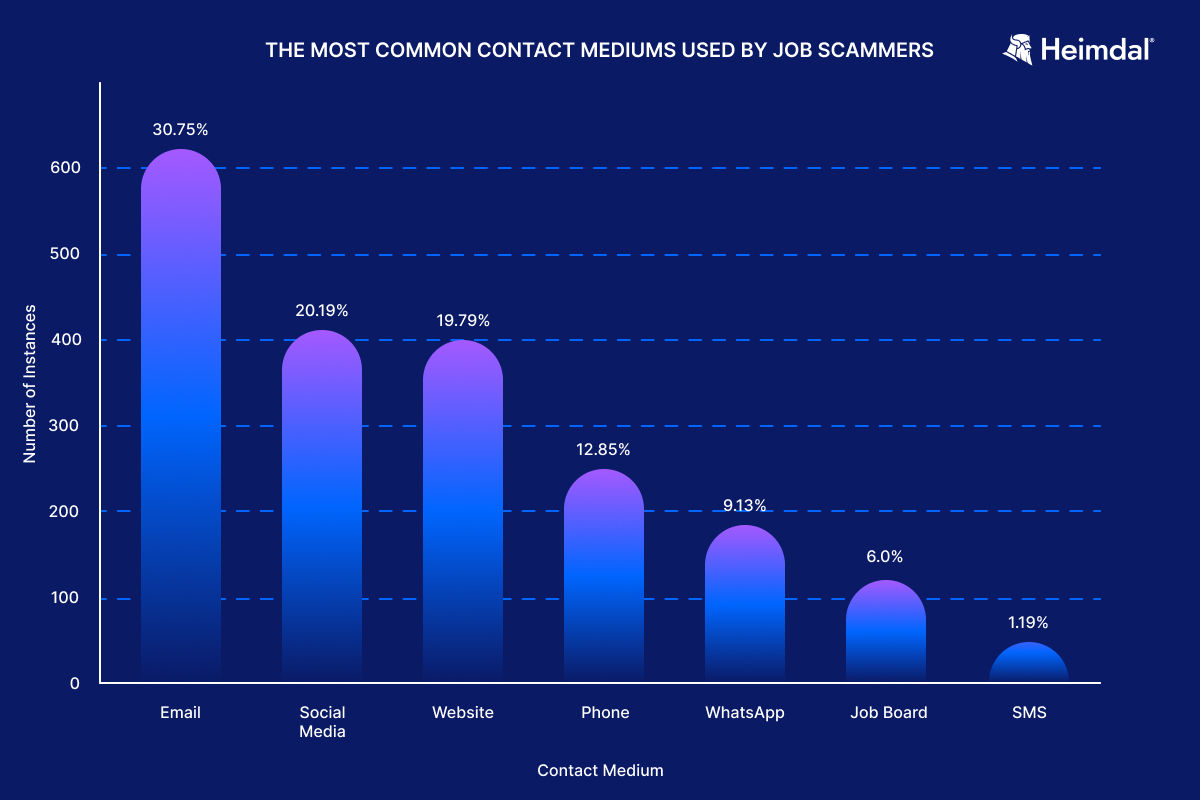

4. Email is the most common contact medium, accounting for 30.75% of the analyzed data. Social media (Facebook, LinkedIn, Instagram, Twitter) follows with 20.19%, websites 19.79%, phone calls 12.85%, and SMS with 1.19%.

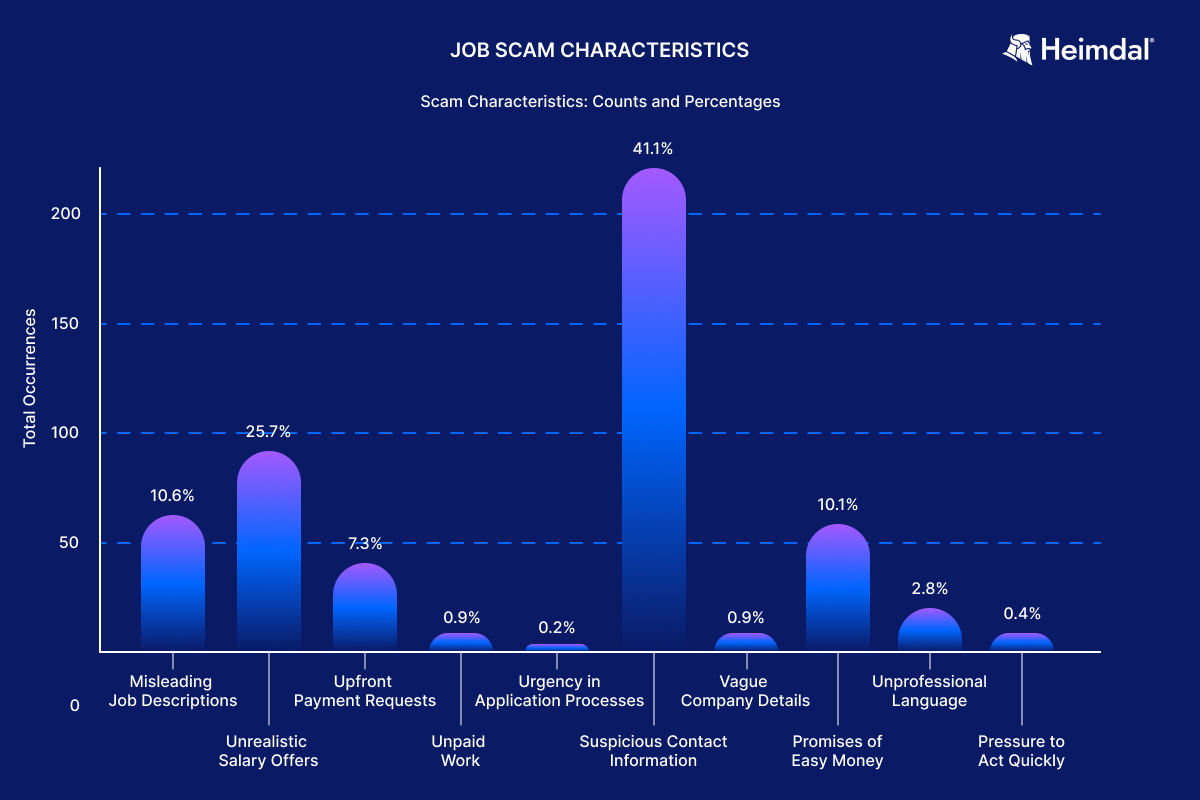

5. The top three job scam characteristics are suspicious contact information (41.1%), unrealistic salary offers (25.7%), and misleading job descriptions (10.6%). Promises of easy money (10.1%), upfront payment requests, unprofessional language, unpaid work, vague company details, and urgency in the application process were also noted in the analyzed data.

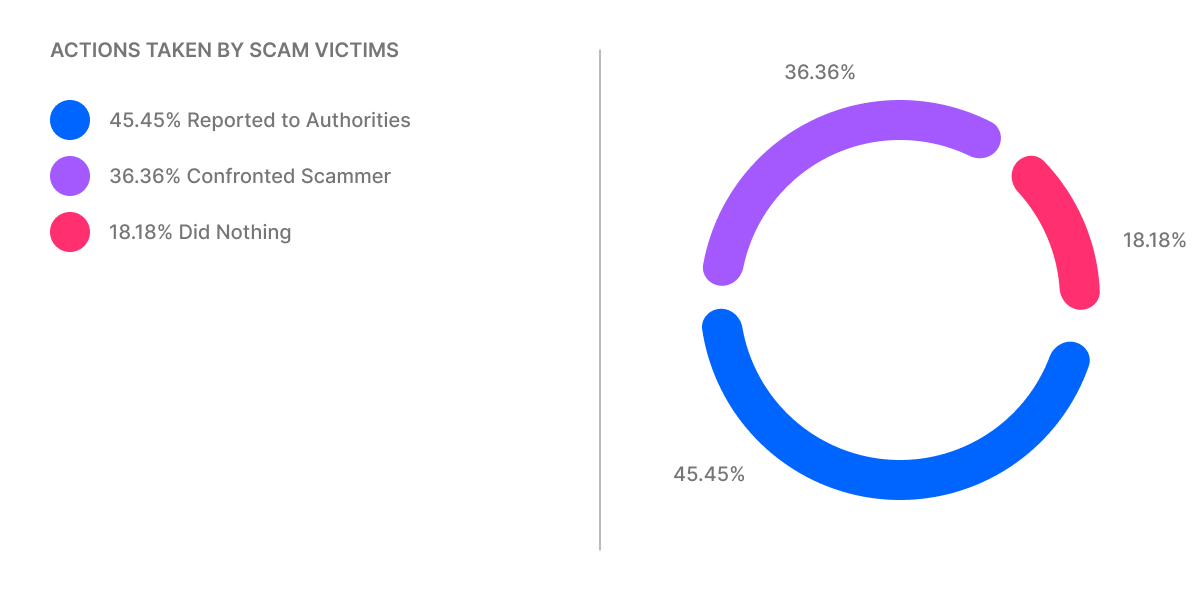

6. A vast number of victims said that they reported the scams to authorities (45.45%), while 36.36% confronted the scammer, and 18.18% did not take action., but they posted their experience on social media to increase awareness.

7. Most of the victims experienced financial loss (55.91%), identity theft (21.51%), while 21% succeeded in detecting the scam early or didn’t experience any harm.

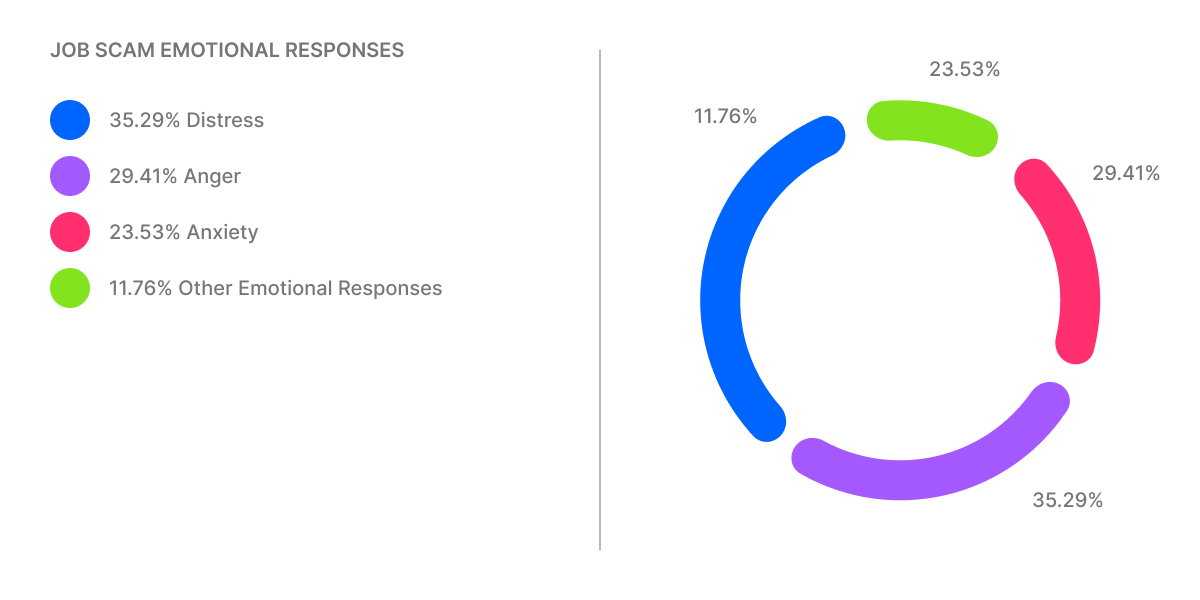

8. The analyzed data shows that the victims experienced distress (35.29%), anxiety (23.53%), anger (9.41%), or other emotional responses (helplessness, regret).

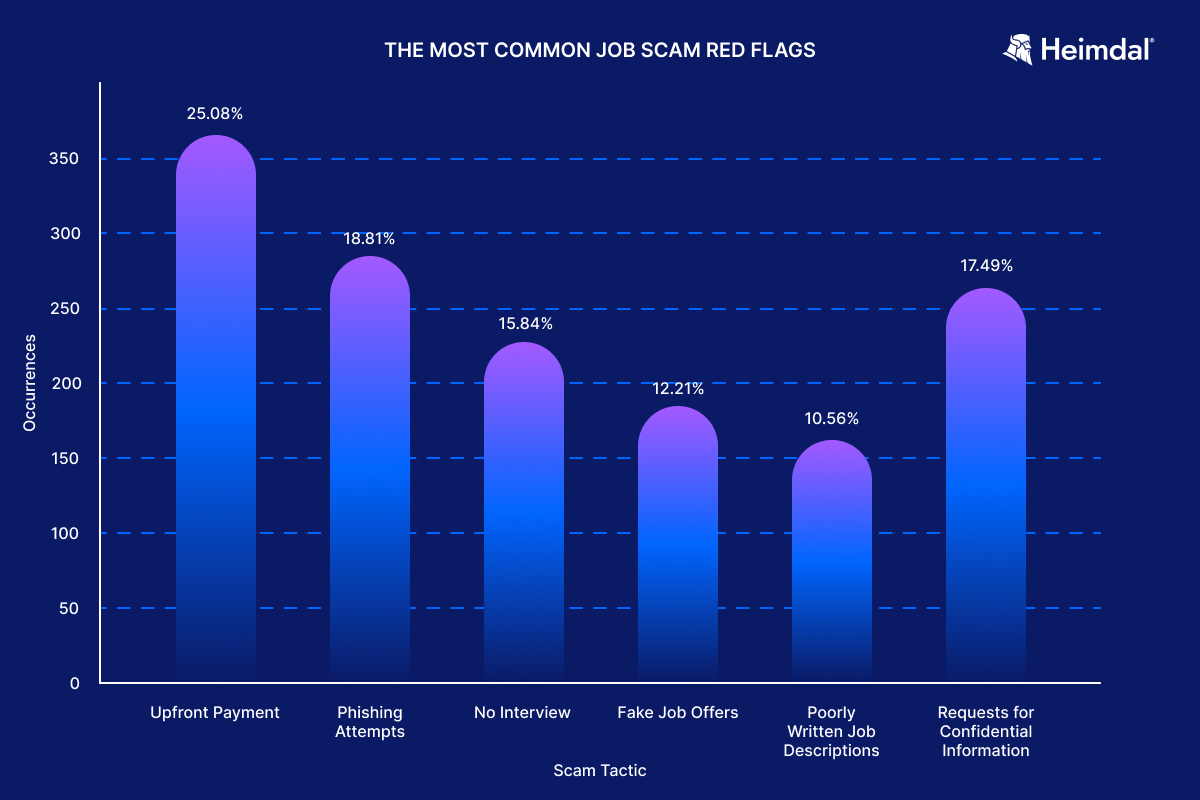

9. The most common red flags were requests for upfront payments (25.08%), phishing attempts (18.81%), requests for confidential information (17.49%), no interview processes (15.84%), fake job offers (12.21%), and poorly written job descriptions (10.56%).

10. The most recommended strategies to avoid scams included checking reviews (26.96%), verifying company information (22.87%), consulting with friends (19.46%), verifying email domains (16.38%), and checking company websites (14.34%).

1. What industries are most targeted?

Key takeaway: Be especially cautious when applying for jobs in sectors such as Finance and IT, as well as remote work opportunities, as these are frequently targeted by scammers.

Our social media analysis shows that job scams target the following industries:

- Finance (35.45%)

- IT (30.43%)

- Healthcare (15.41%)

- Retail (8.77%)

- Education (6.23%)

- Customer Service (3.90%)

Why are scammers targeting these particular industries?

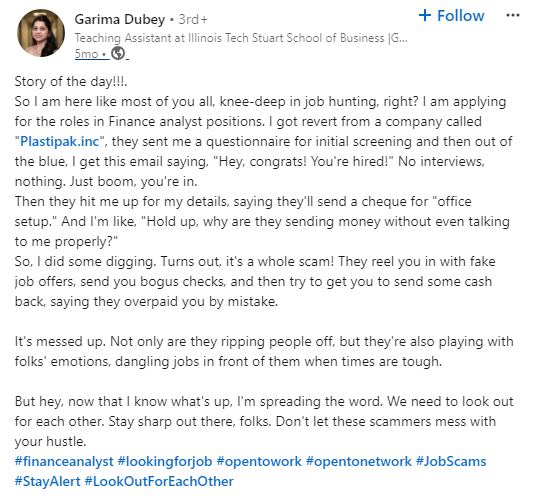

Finance (35.45%)

Finance is at the top of the targeted industries for employment scams with 35.45%. This could be due to the recent layoffs in the finance sector, like those reported by Forbes —where financial and tech companies cut 39,000 jobs in early 2024 — which have made the job market more competitive.

This increased competition means finance professionals are more likely to consider job offers, even from less familiar companies. Scammers exploit this urgency by crafting credible-looking offers.

An example from our data set illustrates how Garima was targeted with a fake “Finance Analyst” position from a company posing as “Plastipak.inc”. She nearly fell victim to a scam involving a fake check for “office setup” costs, showing how scammers use plausible job offers to target job seekers in need.

Another reason could be that scammers target finance professionals to gain access to sensitive financial data, such as client information, bank details, and internal systems.

By using fake job offers, scammers might trick these individuals into revealing valuable data, which could then be used for breaches or sold on the dark web.

Additionally, they could collect personal information to impersonate these professionals in future scams, open fraudulent accounts, or carry out unauthorized transactions.

With over 330,000 business impersonation scams reported by the Federal Trade Commission (FTC) in 2023, many of these scams likely rely on harvested data to appear more credible.

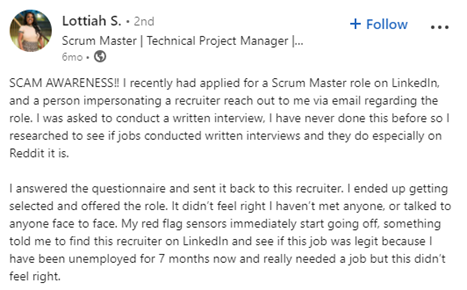

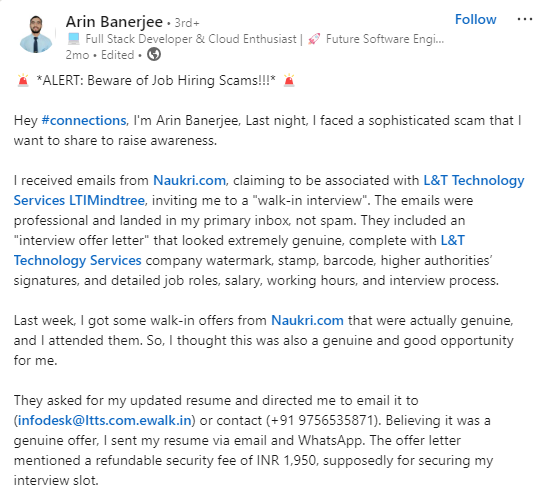

IT (30.43%)

The IT sector, accounting for 30.43% of job scams, is heavily targeted due to high job turnover from rapid technological advancements, frequent restructuring, and project-based work.

Recent layoffs have increased the number of professionals urgently seeking new roles, making them more susceptible to scams.

Scammers exploit this urgency by creating realistic-looking job offers, as seen in the case of Lottiah, who was lured into a scam by a fake remote Scrum Master position sent via LinkedIn.

Scammers might also target IT professionals due to their preference for remote and flexible work opportunities.

Knowing that tech workers highly value flexibility and competitive pay, scammers create fake job offers with these appealing terms.

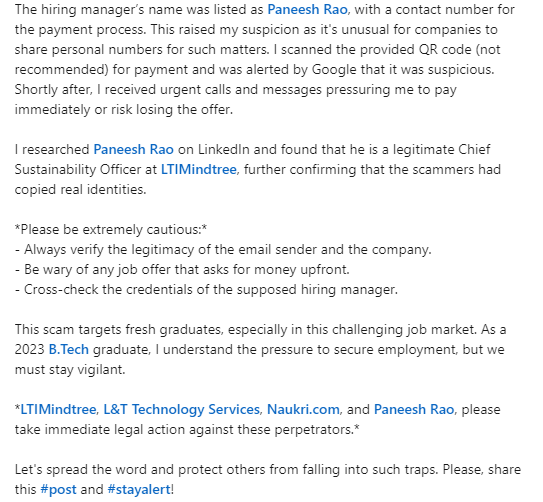

Arin’s example shows how scammers impersonate real companies and individuals to appear credible. Arin received a job offer email from “Naukri.com,” supposedly from a legitimate company, with realistic details like watermarks and signatures.

The scammers even copied a real executive’s identity to add authenticity.

They pressured Arin to make a payment using a QR code and provided urgent calls and messages to rush the transaction.

Lucas Botzen, CEO and HR Expert at Rivermate, a company specializing in Employer of Record (EOR) services, shares his take on the industries that are most targeted:

Having dealt with so many cases from my years of experience in the human resources field, I can attest that while most industries remain potential prey, technology, healthcare, and customer service fields might experience higher exposure.

These are industries where working from home has become common, and fraudsters take advantage of this growing demand for flexible, home-based roles.

Similarly, Mary Zhang, Head of Marketing and Finance at DgtlInfra, notes:

From our experience, the tech industry is heavily targeted by job scams, particularly roles in cybersecurity and data analysis.

Scammers often exploit the complexity of these fields to create convincing fake job postings.

Healthcare (15.41%)

The healthcare sector is the third most targeted, accounting for 15.41% of job scams.

This sector might be particularly vulnerable due to the high demand for healthcare professionals and the urgency associated with these roles.

Scammers exploit this demand by creating fake job offers that appear urgent or necessary.

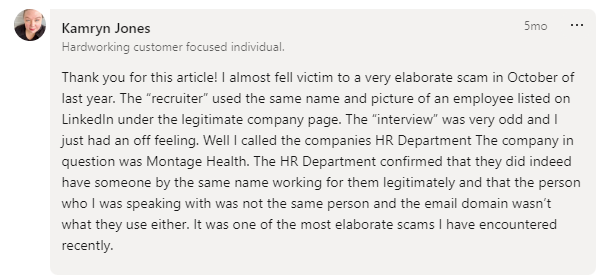

A comment from one of our analyzed social media posts shows how Kamryn almost fell for a scam where a “recruiter” used the name and photo of a real employee from Montage Health.

The scam involved an unusual interview process and a fake email domain, illustrating how scammers impersonate real healthcare workers to gain trust and deceive job seekers.

Retail (8.77%)

The retail sector, accounting for 8.77% of job scams, is the fourth most targeted. Its high turnover rate and seasonal employment patterns might contribute to its susceptibility to scams.

In 2023 alone, as per Personnel Today, nearly 120,000 retail jobs were lost due to factors like company restructures, cost-cutting, and economic challenges.

This high turnover rate and the constant need for new employees make it easier for scammers to exploit the situation by posing as recruiters for legitimate companies, offering fake job opportunities to unsuspecting job seekers.

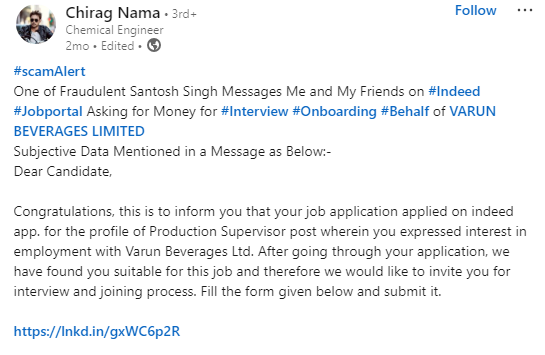

For instance, Chirag reported a scam on LinkedIn where he and his friends received messages from someone impersonating a recruiter for “Varun Beverages Limited.” The scam involved asking for money under the guise of interview and onboarding fees.

Education (6.23%)

The education sector ranks fifth, making up 6.23% of job scams. The education sector could be targeted by scammers due to the ongoing demand for educators and administrative staff and the perceived job stability in these roles.

Scammers might use this to their advantage by offering fake jobs, appearing legitimate, and charging fees for certifications or background checks.

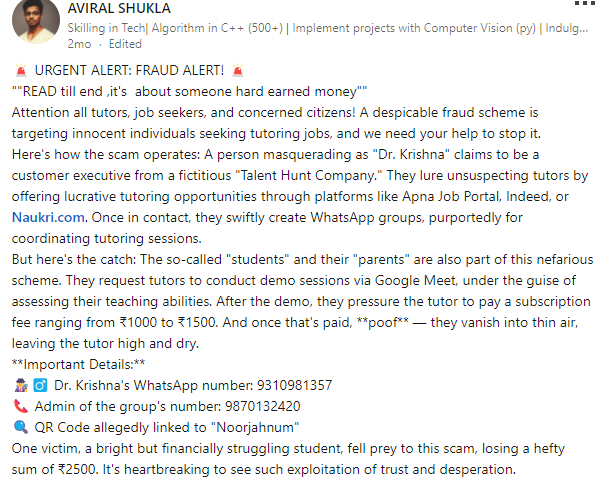

In the example below, Aviral described a scam where individuals, posing as representatives from a “Talent Hunt Company,” offered tutoring positions through well-known platforms like Naukri.com.

They created WhatsApp groups to coordinate sessions, asked for demo classes, and then demanded a subscription fee. Once the fee was paid, the scammers vanished, leaving the victims deceived and financially impacted.

Customer service (3.90%)

Last but not least, the customer service sector is the sixth most targeted, representing 3.90% of job scams and is a frequent target due to the high demand for remote roles.

Scammers exploit this by posting fake job ads and asking for sensitive information under the guise of background checks or security deposits.

For example, Darrell reported a scam where he received an email after applying for a customer service position, asking him to complete a background verification via a link.

Spencer Romenco, Chief Growth Strategist at Growth Spurt, highlights an often overlooked sector:

There’s a less obvious industry that’s getting hit hard—creative and freelance work.

With the rise of the gig economy, more people are seeking freelance gigs, and scammers have caught onto this.

2. Does job location affect scam risk?

Key takeaway: It might seem logical to think scammers mostly exploit the remote work trend, but that’s not the full picture.

Scammers are just as likely to use on-site and hybrid job offers to appear credible. By diversifying their approach, they adapt to various job types and preferences, increasing their chances of successfully deceiving potential victims.

Our analysis revealed that:

- 43% of the job scam posts mentioned remote positions,

- 42% were on-site,

- and 15% were hybrid.

Remote positions

In the case of remote jobs, the lack of physical verification processes and the increasing trend towards remote work provide fertile ground for scammers.

For example, Mishal shared an encounter where a LinkedIn recruiter offered a remote job with unusual requirements, such as a mandatory British accent and odd working hours, raising doubts about the job’s authenticity.

Albert Kim, VP of Talent at Checkr, a background-checking SaaS solution, explains:

Remote roles are the most targeted across every industry because they’re so easy to fake.

Your candidates aren’t heading to an office for an in-person interview, so it’s difficult to confirm the hiring manager’s legitimacy.

Cache Merrill, Founder, CEO, and CTO of Zibtek, adds:

Most often, you’ll see scammers targeting remote roles because it’s so easy to hide behind the internet.

Now that AI is making it easier to create more sophisticated fake websites, emails, and more, it’s much harder for candidates to differentiate what’s real from what’s not.

On-site positions

On-site roles also face significant scamming activities, as they often carry perceived legitimacy.

Scammers might invite job seekers for in-person interviews to collect personal information or charge upfront fees.

In an example from our data set, Richard reported receiving an email for an on-site interview that seemed legitimate, including an ID verification process, but later discovered it was a scam.

Hybrid positions

Hybrid jobs, combining remote and on-site work, add new layers of complexity that scammers can exploit.

They offer a perfect mix of flexibility and physical presence, which scammers can use to seem more credible while maintaining some anonymity.

3. Which roles are most vulnerable?

Key takeaway: The higher the target, the greater the risk—a scam can turn a manager into an insider threat, exposing valuable company data.

Meanwhile, entry-level job seekers, eager for their first role, may ignore warning signs and fall for simpler scams. Whether you’re starting out or advancing in your career, always carefully evaluate job offers.

Our analysis revealed that scams are heavily concentrated around:

- Managerial (35%)

- Entry-level positions (34%)

- Mid-level (18%) and senior roles (13%) are also targeted, but less frequently.

Both managerial and entry-level job seekers face significant risks, but scammers target these roles for different reasons.

Why are managerial roles targeted?

Scammers might target managerial positions (35%) because these roles offer higher salaries, making managers more inclined to overlook red flags in hopes of securing substantial pay increase.

High salaries and compensation packages

The promise of a lucrative position makes the victim more willing to engage and comply with requests, such as paying for “equipment” or “background checks” that scammers claim are necessary to secure the job.

For example, Ana shared how she was approached by a scammer posing as a recruiter, offering a check to purchase equipment for a project manager position. Luckily, she spotted the scam right away.

The “bogus check” technique isn’t new, a study from 2023 by BBB (International Association of Business Bureaus) showed that 36% of their survey respondents said they had encountered fake check scams.

Most of these are business checks often stolen by scammers from mail and altered using graphic programs to look professional.

Scammers reassure victims that they’ll cover costs by sending a check in advance.

Victims deposit the check, and when the bank has credited the money to their account they believe that the check is valid.

Victims then send money to pay for the items needed for the “job,” (which they never receive). When the bank realizes the check is fake, it withdraws the credited amount from the victim’s account, leaving them at a loss.

Access to sensitive information

Managers often have decision-making authority and access to valuable information, such as company finances, personnel records, or proprietary data.

Scammers may target them with fake job offers to gain access to this sensitive information. Once trust is established, the scammer might:

- Send phishing emails to steal login credentials.

- Use social engineering to manipulate the manager into sharing financial records or trade secrets.

- Install keyloggers via malicious attachments to capture sensitive data.

These actions could all lead to a data breach, affecting either the manager’s personal financial information or the company’s data (especially if the manager is applying from a work device).

Why are entry-level roles targeted?

Entry-level job seekers are almost equally (34%) vulnerable to job scams, but for different reasons.

Lack of experience

Many entry-level candidates are new to the job market and simply lack experience in recognizing fraudulent job offers.

Scammers take advantage of this by crafting offers that seem too good to be true—such as remote work with high pay and flexible hours.

An example from our data set – shows how a Reddit user applied for an entry-level data entry job that seemed appealing… but quickly grew suspicious when the offer promised unusually high compensation for minimal effort.

Fortunately, the user reached out for help on social media, where other users confirmed it was likely a scam.

Albert Kim, VP of Talent at Checkr, a background-checking SaaS solution, shares his take on the matter:

Scammers generally hit entry-level roles because management and senior positions require more intensive interview and assessment processes.

Scammers aren’t in the business of working hard, so they’ll take the easiest path to free money rather than taking the time to fake three rounds of interviews.

More chances to scam

Another reason entry-level roles are often targeted could be due to the sheer volume of applications they receive.

Positions that require minimal experience naturally attract a larger pool of applicants. The more applicants, the more chances to scam.

Scammers might use mass emails, job boards, and social media platforms to reach these candidates.

In April 2024, the Federal Trade Commission (FTC) posted a consumer alert advising college students to be cautios when looking for virtual jobs, especially if the new employer asks them to deposit any type of check, no matter how convincing it sounds.

“Your boss should be paying you, not the other way around”, the FTC emphasized.

4. What is the main contact method for scammers?

Key takeaway: Scammers are not too picky with their mediums, they’ll try pretty much every medium out there to appear legitimate to the unsuspecting eye.

From traditional to modern, they will reach their victims via: email, social media posts, fake websites, phone calls, and messaging apps.

Our data shows that job scammers use the following mediums:

- Email: 30.75%

- Social Media (Facebook, LinkedIn, Instagram, Twitter): 20.19%

- Fake Websites: 19.79%

- Phone Calls: 12.85%

- WhatsApp: 9.13%

- Job board: 6%

- SMS: 1.19%

According to Lucas Botzen, CEO and HR Expert at Rivermate, a company specializing in Employer of Record (EOR) services:

The contact methods I have come across most are job platforms and social media, especially LinkedIn.

Another big contributor is email phishing: fraudulent job offers coming right into your inbox. Most of those emails would appear to be from a legitimate company, save for one or two deviations in the domain name.

Why is email the most popular medium for scammers (30.75%)?

Email is the most popular contact medium for scammers, and the reasons why are pretty simple.

- Easy to obtain

Email is the foundation of our digital identity and it’s relatively easy to obtain. Scammers can harvest email addresses from legitimate sources like marketing databases (e.g., Cognism) or from nefarious sources like the dark web.

- Mass reach with botnets

Scammers often use botnets—networks of compromised devices—to send large volumes of emails simultaneously, reaching thousands and even millions of users with minimal effort.

At the beginning of this year, the Cybernews team revealed a supermassive leak containting data from previous beaches, comprising 26 billion records (with data from LinkedIn, X, Adobe, MyFitnessPal, Canva, Badoo, and many other platforms).

Additionally, AI tools have increased phishing attempts by 1265% since 2022, making these emails more personalized and harder to detect.

The combination of massive data leaks and advanced AI tools means that job seekers are at greater risk than ever before. Scammers can reach more potential victims quickly and with highly believable content.

- Strategic timing and perceived legitimacy

Once scammers obtain an email address, they can use it to launch various attacks, taking advantage of both timing and the trust people place in email communications:

- Phishing: sending fake emails that look like they come from trusted sources to steal personal information.

- Spear Phishing: crafting emails with personalized details to make them appear more credible.

- Business Email Compromise (BEC): pretending to be executives or colleagues to ask for sensitive information or money.

- Malware Distribution: disguising harmful links or attachments as legitimate documents.

Job scams are a prime example where scammers use email to exploit timing and trust.

They often strike when people are most vulnerable, such as during a job search, using tactics that make their emails seem legitimate.

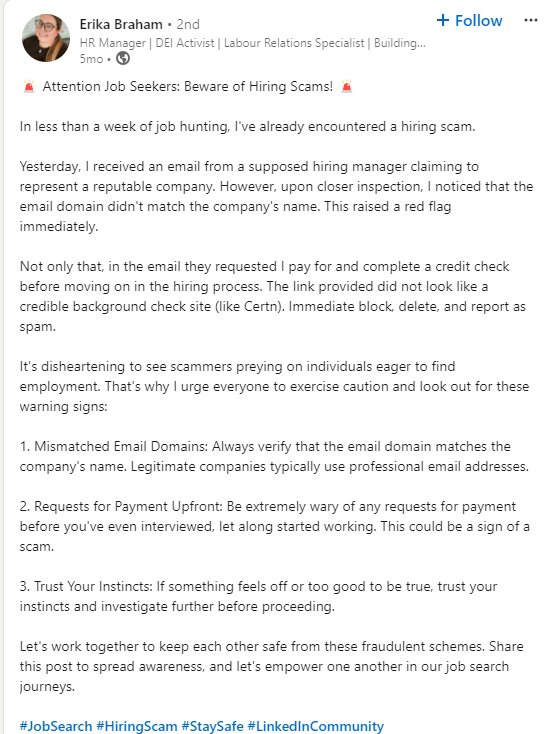

For example, Erika received a scam email from a “hiring manager” just a week into her job search. The email appeared to be from a well-known company, and it was well-written and personalized, giving it a sense of legitimacy.

However, Erika noticed the email had a mismatched domain and requested a payment for a “credit check.” Trusting her instincts, she reported it.

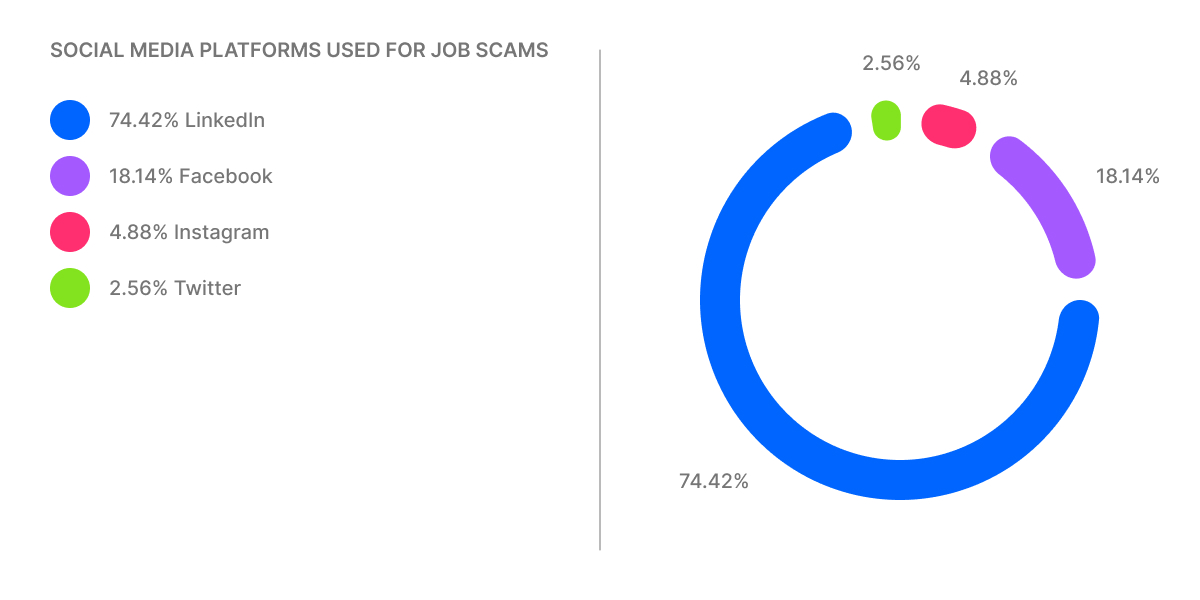

Social media as a medium for job scams (20.19%)

Our data shows that the most used social media platforms to perform job scams are:

- LinkedIn: 74.42%

- Facebook: 18.14%

- Instagram: 4.88%

- Twitter: 2.56%

What’s popular among job seekers is also popular among job scammers. These platforms attract scammers by providing direct access to a large audience of job seekers and professionals.

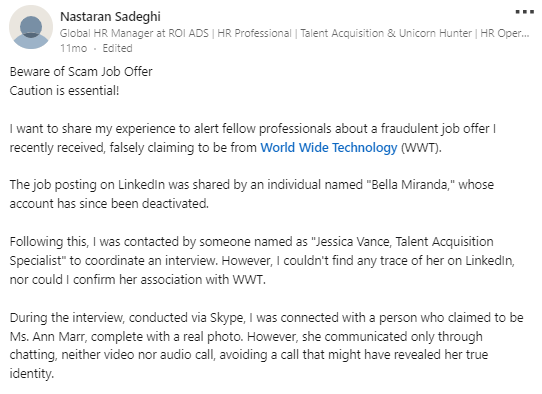

LinkedIn’s high value (74.42%)

LinkedIn is a prime target for job scams due to its focus on professional networking. Users on LinkedIn actively seek high-value job opportunities, making them ideal targets for scammers offering lucrative, but fake, job positions.

For example, Nastaran received a fraudulent job offer on LinkedIn claiming to be from World Wide Technology. The scam used the name of a reputable company and a fake profile to appear legitimate, exploiting LinkedIn’s professional environment to gain trust.

Mary Zhang, Head of Marketing and Finance at DgtlInfra, a digital infrastructure firm, observes:

LinkedIn has become a hotspot for these scams. We’ve noticed a trend of scammers creating fake recruiter profiles and connecting with potential victims.

In one instance, a fake recruiter targeting our employees had over 500 connections before we identified and reported the account.

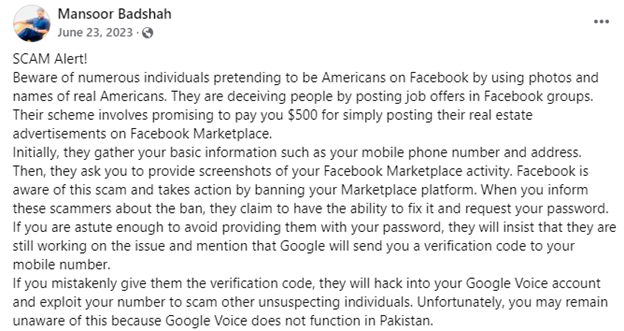

Facebook’s broad reach (18.14%)

Facebook’s massive user base and the ease of creating fake profiles and pages make it an attractive platform for scammers.

For example, Mansoor shares a scam alert about individuals posing as Americans using stolen identities and images on Facebook.

- The scammers deceive users by posting fake job offers in Facebook groups, promising easy money for tasks like posting advertisements.

- They first gather basic details like phone numbers and addresses, then ask for more information, such as screenshots of the user’s Facebook Marketplace activity.

- If the user is suspicious and doesn’t provide their password, the scammers escalate their tactics, requesting a Google verification code to access the user’s account and exploit their number for further scams (also known as Google Voice scam).

The BBB reported that a new generation of scammers advertise jobs on the web and social media, or reach out to those who have posted resumes on job boards. These changes increase the risks of identity theft.

Scammers also use Instagram (4.88%) and Twitter (2.56%) for job scams because these platforms allow them to quickly create fake profiles that mimic real companies, and they exploit the trust users place in social networks to appear more credible.

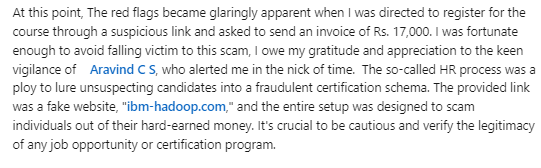

Fake websites: 20.19% of job scams

Websites are also a significant target for scammers. The “website” medium typically refers to instances where the scammer directs the potential victim to a fraudulent or suspicious website.

Scammers frequently use fake websites to target job seekers, creating convincing job listings or mimicking legitimate company sites to make their offers appear genuine.

These sites often use logos, design elements, and even employee names to appear credible. As per Swiss Cyber Institute,1.5 million new phishing websites are created monthly.

For example, one job seeker narrowly avoided falling victim to a scam when they were asked to register for a course through a suspicious link and send an invoice for Rs. 17,000 (€200). The link led to a fake website, ibm-hadoop[.]com, that was set up to deceive candidates and steal money.

Taking an extra step, like checking the official company websites often helps victims identify the fraud.

Phone calls (12.85%) and WhatsApp (9.13%)

Scammers have found that sometimes the most effective approach is the most direct. That’s why they often rely on phone calls and WhatsApp messages to reach their targets, leveraging these channels to create urgency and a sense of personal connection.

Phone calls

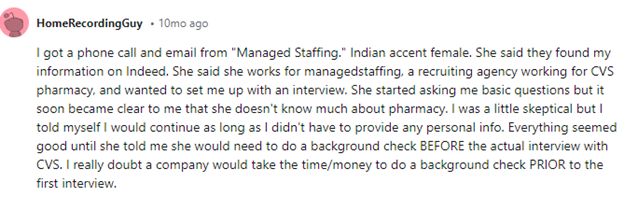

Phone calls account for 12.85% of all scam recruitment methods, and they work by tapping into the immediacy and trust people tend to associate with voice communication.

One Reddit user shared how they received a call from someone claiming to be a recruiter for CVS Pharmacy. The caller’s questions started off simple enough, but soon it became clear she didn’t know much about the industry.

When the “recruiter” asked for a payment for a background check before any interview, the alarm bells started ringing. This example shows just how scammers use phone calls to build rapport and push for quick decisions.

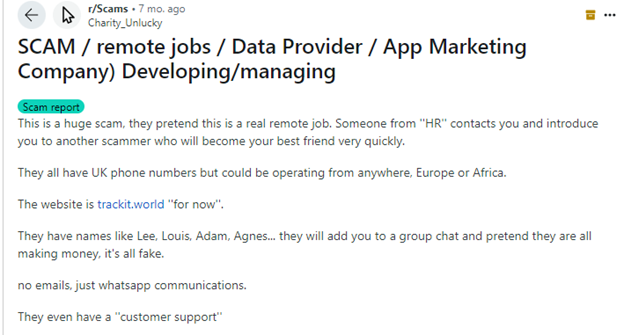

WhatsApp isn’t far behind, making up 9.13% of contact methods. Its informal and immediate nature allows scammers to engage potential victims in a way that feels personal.

Another Redditor recounted being added to a WhatsApp group with supposed recruiters and other candidates.

The group’s friendly chats quickly turned into requests for money under the guise of processing fees. The casual back-and-forth can make it hard to spot the scam until it’s too late.

Job boards (6%) and SMS (1.19%): scammers on the lookout for every opportunity

Scammers are also exploiting job boards, which account for 6% of the job scam mediums in our data.

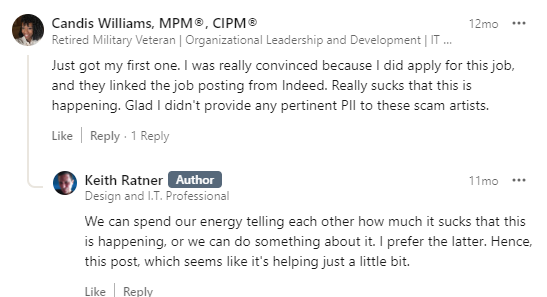

According to an FTC Consumer Alert scammers often hijack job ads. They’re taking outdated ads from real employers, change them, and post them on employment websites and career-oriented platforms. The modified ads seem to be real job offers with legitimate companies.

For instance, Candis shared her experience on social media about nearly falling for a scam. She applied for a job through Indeed and received a convincing response that linked back to the original posting.

“I was really convinced because I did apply for this job, and they linked the job posting from Indeed. Really sucks that this is happening,” she wrote, relieved she hadn’t provided any sensitive information to the scammers.

Spencer Romenco, Chief Growth Strategist at Growth Spurt, shares his experience with job scams:

What’s even more surprising is the growing use of job boards and freelance platforms as a tool for scammers. Sites like Upwork or Fiverr, which should be safer spaces, are also seeing an increase in these types of scams.

It all starts with an SMS

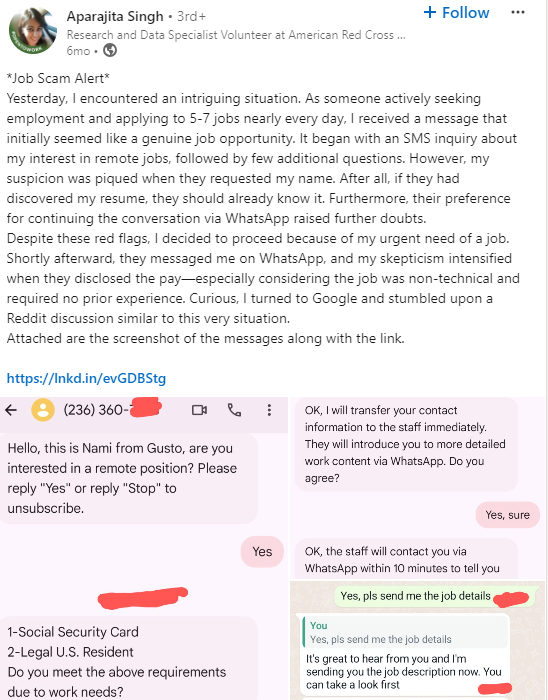

While SMS job scams account for a smaller percentage (1.19%), they remain a potent medium for scammers.

With just a text message, scammers can bypass email filters and reach potential victims directly on their phones, using urgent language to lure them into a trap.

For example, Aparajita shared how they received an SMS that seemed like a genuine job inquiry. The message asked if Singh was interested in a remote position and requested a response to continue

Upon replying, the conversation shifted to WhatsApp, where scammers quickly asked for sensitive information, like a Social Security card and residency status, under the guise of a job offer.

5. What are the top job scam characteristics?

Key takeaway: Job scammers are getting smarter and bolder, using a combination of psychological manipulation and digital tactics to deceive job seekers.

Understanding the most common scam characteristics—such as suspicious contact information, unrealistic salary offers, and misleading job descriptions—can help job seekers protect themselves from falling prey to these schemes.

Based on the data analyzed, here’s a breakdown of the most common characteristics:

- Suspicious Contact Information: 41.1%

- Unrealistic Salary Offers: 25.7%

- Misleading Job Descriptions: 10.6%

- Promises of Easy Money: 10.1%

- Upfront Payment Requests: 7.3%

- Unpaid Work: 0.9%

- Urgency in Application Processes: 0.9%

- Vague Company Details: 0.2%

- Unprofessional Language: 2.8%

- Pressure to Act Quickly: 0.4%

Understanding the most common job scam characteristics

Suspicious contact information (41.1%)

Suspicious contact details, such as non-professional emails or unfamiliar phone numbers, are the most common job scam characteristics.

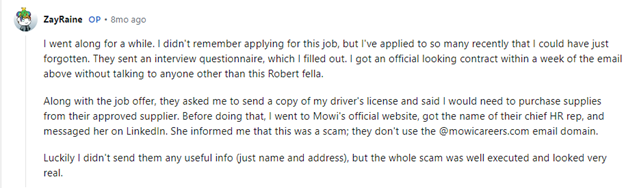

For example, this Reddit user shared their experience of receiving an official-looking contract from someone named “Robert” after completing an interview questionnaire.

The email, however, came from a domain not used by the legitimate company. So the user verified with the company’s HR representative, who confirmed it was a scam.

Why it works?

Scammers rely on job seekers overlooking minor discrepancies, like slight variations in email domains or unrecognized numbers, especially when under pressure to find a job.

As per a BBB report, users should examine the email address of those offering jobs to see if it matches the protocols used by an actual company. And pay close attention to Gmail business email addresses.

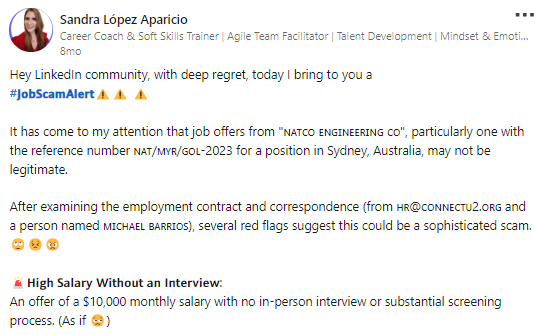

Unrealistic salary offers (25.7%)

Offering too-good-to-be-true salaries is another common characteristic, making up for 25.7% of analyzed posts.

Scammers know that high-paying positions grab attention, especially in competitive job markets. As was the case with Sandra, who received a job offer from “Natco Engineering” and was promised a $10,000 monthly salary with no in-person interview or proper screening process.

High-salary offers are designed to catch attention and seem like a rare opportunity. They can create excitement, and when someone is excited about the potential of landing a high-salary job, they are… less likely to scrutinize the details of the offer.

According to the FTC, salaries that are out of line with industry norms should immediately raise your suspicions.

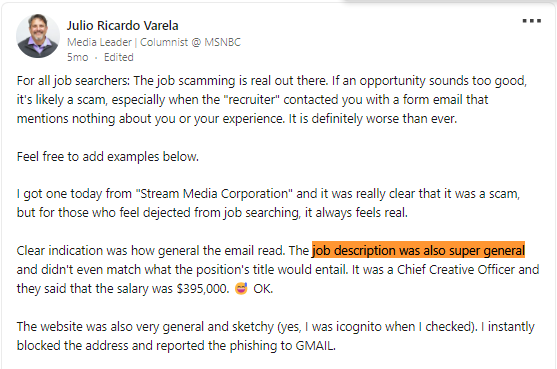

Misleading job descriptions (10.6%)

Victims might receive job descriptions that are vague or seem too good to be true.

Misleading job descriptions account for 10.6% of the analyzed posts. By avoiding specifics, they can attract more candidates and increase their chances of success before the victim realizes the offer isn’t legitimate.

For example, Julio shared his experience with a scam job listing for a Chief Creative Officer role offering a salary of $395,000. The job description was too general and didn’t align with what the title would normally entail.

Although it wasn’t Julio’s case, often by the time a job seeker realizes the offer is suspicious, they may have already shared personal information or engaged further with the scam.

Promises of easy money (10.1%)

Another common characteristic is the promise of easy money, making up 10.1% of the analyzed posts of people who encountered job scams.

Scammers might offer unrealistic pay for little to no work, preying on job seekers who are looking for quick and simple ways to earn money.

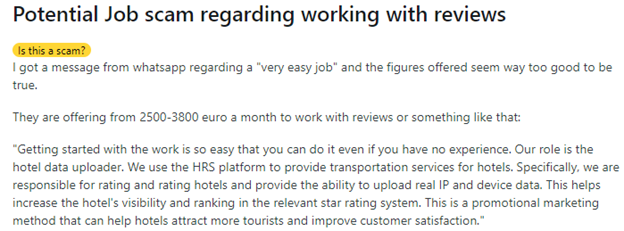

For instance, a Reddit user shared his experience with a job scam where they were offered between 2,500–3,800 euros per month just to upload hotel reviews. The scammer claimed it was an easy job that could be done with no prior experience.

The “easy money” method works because it appeals to job seekers who are either struggling financially or looking for quick income. When faced with limited options or during tough economic times, the promise of fast cash with minimal effort is highly attractive.

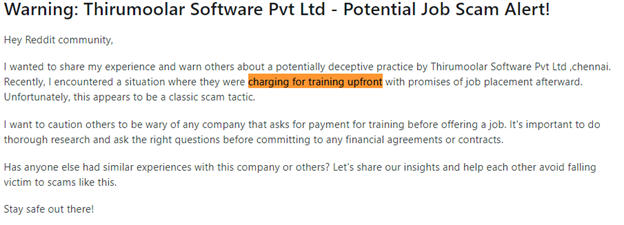

Upfront payment requests (7.3%)

Scammers commonly demand upfront fees for certifications, registrations, or training before allowing job seekers to proceed with their applications.

This can be particularly convincing for roles that seem prestigious or in-demand, where candidates might believe that such payments are necessary for background checks, equipment, or mandatory training. However, legitimate employers generally do not ask for payments from applicants.

For example, a Redditor shared his experience with a recruiter who claimed to arrange job interviews with two Dubai-based companies, but there was a catch: they required an upfront fee of $400 for these interviews.

The person on the call seemed convincing, insisting that they weren’t guaranteeing a job, just interview arrangements. They assured that if the candidate didn’t pass the interviews, the fee would be refunded.

This taps into job seekers’ desire to secure opportunities, but ultimately leads to financial loss. The takeaway here is clear: legitimate companies don’t ask for upfront payments. Be wary of any job opportunity that requires fees before you’ve secured the position.

For instance, in a notorious case brought by the FTC, a company called Worldwide Executive Job Search Solutions was permanently banned from providing employment services after scamming consumers with false promises of high-paying finance jobs.

The company charged fees of up to $2,500 for bogus job interviews and resume repair services, and often pressured job seekers into paying upfront to even be considered for non-existent jobs.

As the FTC’s Bureau of Consumer Protection emphasized, “If a recruiter asks you to pay for access to job listings or interviews, you should be on your guard.”

Unprofessional language (2.8%)

Poor grammar, spelling mistakes, and unprofessional language can be indicators of job scams. Many scammers don’t invest the time or effort into crafting polished, professional communications.

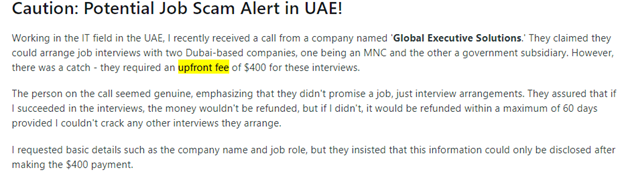

For instance, Nichola shared her experience of receiving poorly written job offers filled with grammatical errors. This unprofessional approach immediately raised red flags and helped her identify the offers as fraudulent.

Unpaid work (0.9%)

Sometimes, scammers use to get victims to complete tasks with the promise of future payments or job opportunities that never materialize.

These scams exploit individuals’ hope for legitimate employment, tricking them into providing services without compensation.

As seen in Ankit’s example, companies lure people in with false promises of employment opportunities or training programs, only to fail to deliver and leave victims unpaid despite their efforts.

This approach works because individuals are eager to prove themselves in a tough job market and might believe that completing initial tasks will secure them future employment.

Vague company details (0.9%)

A legitimate job posting typically includes clear information about the hiring company, its location, and its background.

Scammers, on the other hand, often avoid providing specific company details. This tactic helps them remain anonymous and prevents victims from verifying the legitimacy of the job offer.

Pressure to act quickly (0.4%)

Scammers create a sense of urgency, making the victim feel like they need to act fast to avoid missing out on the opportunity.

This rush prevents candidates from taking the necessary time to verify the job offer or perform due diligence.

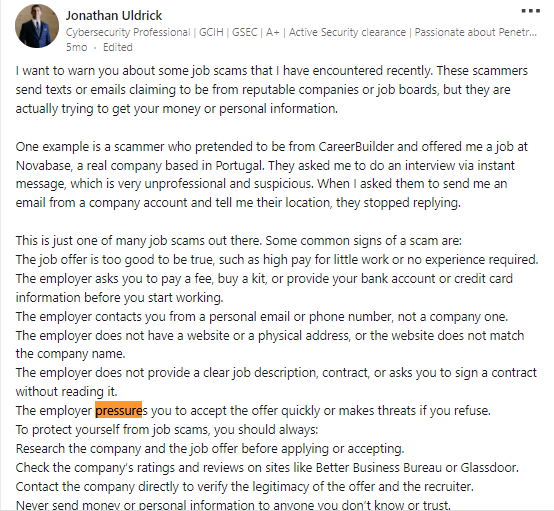

In a Linkedin post, Jonathan emphasized that scammers could pressure candidates to accept offers quickly or sign contracts without sufficient time for review.

Why it works?

This is a purely psychological trick. By creating a sense of urgency, scammers push victims to make hasty decisions.

A study from the Association for Psychological Science highlights that stress and urgency can cloud critical thinking, making it harder for individuals to weigh options rationally.

Desperation or excitement over what seems like a great job offer might cloud judgment, leading the victim to bypass important verification steps.

Urgency in application processes (0.2%)

Along with pressure, scammers create urgency in the job application process. They might say that the position will be filled soon or that they need an immediate response.

This method is designed to give victims less time to scrutinize the offer or check the background of the employer.

Many job seekers want to secure a job as quickly as possible. And urgency can push people into action without taking the time to question whether the job offer is genuine.

6. How do victims typically respond?

Key takeaway: Most job scam victims report their experiences to authorities, while others directly confront scammers or raise awareness via social media.

By sharing their stories, victims help protect others and contribute to collective efforts in fighting job scams. Raising awareness empowers communities and helps prevent future scams.

Our data shows that:

- 45% of victims reported the scam to authorities,

- 36% confronted the scammer directly,

- and 18.18% did not take any action, except for sharing their experience on social media.

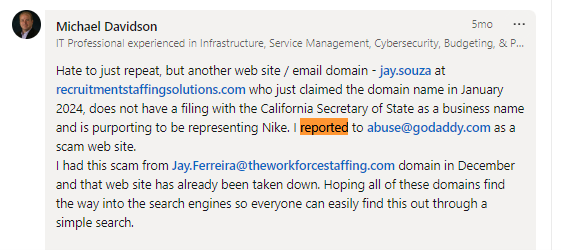

Reported to authorities (45.45%)

Most victims turn to official channels, such as the police or consumer protection agencies, to report job scams.

This reflects the growing recognition of the importance of involving authorities in fraud cases. For instance, Michael shared his experience of reporting a scam website impersonating Nike to abuse@godaddy.com, leading to the site being taken down.

Reporting job scams to relevant authorities is important, because it allows law enforcement to track scam trends and potentially hold scammers accountable. It also raises awareness about fraudulent job postings, leading to takedowns of malicious sites or accounts.

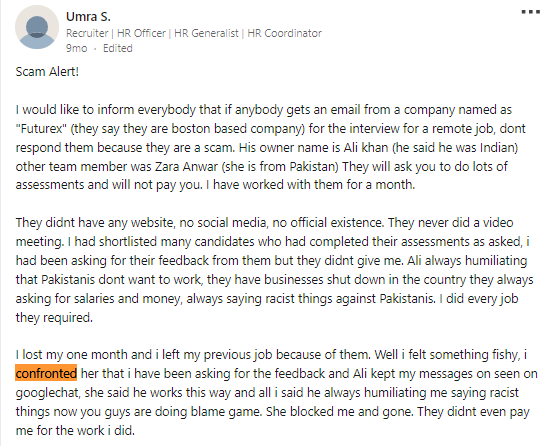

Confronted the scammer (36.36%)

Another common response is confronting the scammer directly.

Some victims, like Umra, try to get answers from scammers, demanding explanations or payments. Though confrontation often leads nowhere, it is an immediate response when victims feel they can expose the scam.

In other situations, confronting scammers can lead to immediate red flags becoming clearer, helping victims confirm the scam. However, it’s risky as it doesn’t guarantee a resolution and can further expose victims to manipulation.

Shared on social media (18.18%)

Sometimes, sharing experiences on social media is enough to help raise awareness and warn others about potential scams.

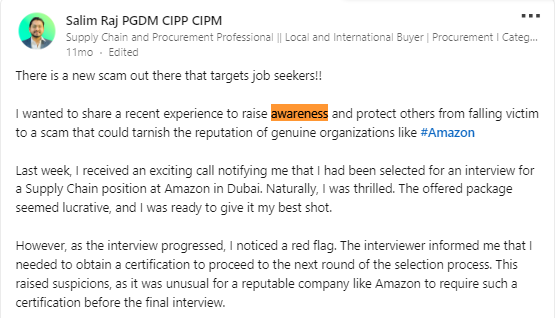

Salim, for example, shared his scam experience involving a fake Amazon interview, alerting his professional network on LinkedIn.

Sharing experiences on social media helps to create a network of awareness. Many individuals look to social platforms like LinkedIn or Reddit to research potential employers or job offers, making these platforms valuable for scam prevention.

7. Is financial loss the most common outcome?

Key takeaway: Job scams can result in severe financial and emotional harm. The most common outcomes include financial loss and identity theft.

Early detection, however, can significantly reduce these risks. By remaining vigilant and verifying job offers, job seekers can protect themselves from falling victim to these scams.

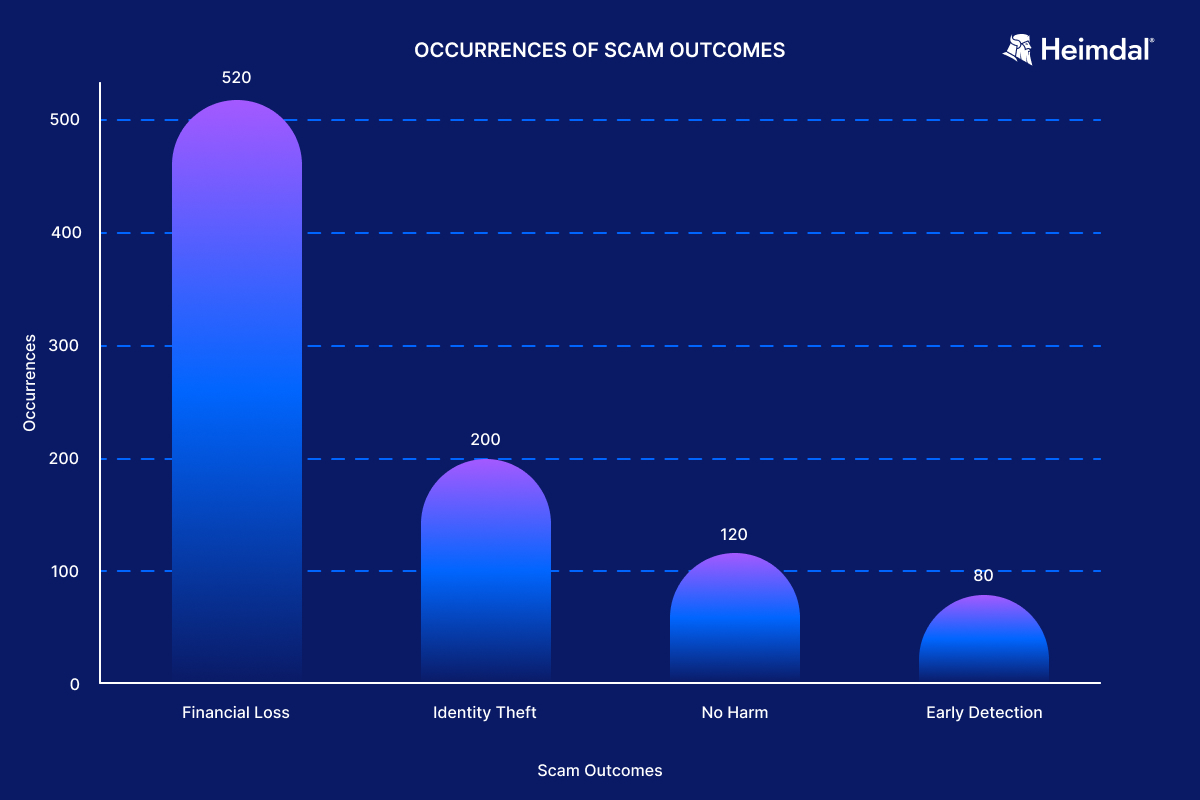

Our data revealed that 520 victims experienced financial loss, 200 suffered identity theft, 120 reported no harm, and 80 were able to detect the scam early.

Financial Loss

The most prevalent outcome of job scams is financial loss, indicating that scammers are primarily driven by financial motives.

Many victims end up losing significant amounts of money, whether through upfront payment schemes, fraudulent job offers, or task scams.

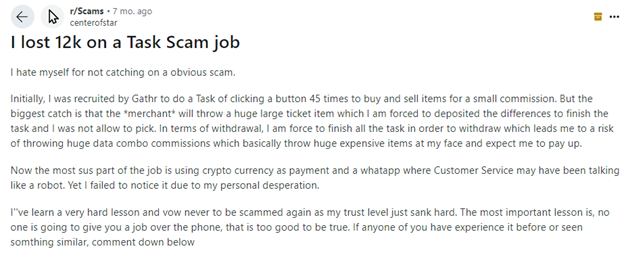

One Reddit user shared their experience of losing $12,000 on a ‘task scam job’ that involved completing tasks and then being forced to deposit more money to continue.

- The scam started with simple tasks like clicking buttons to buy and sell items for a small commission.

- However, the victim was eventually asked to pay upfront for larger “ticket items” before being able to withdraw any earnings.

- This snowballed, and the victim ended up losing a substantial amount of money, with the scam using cryptocurrency payments, making it harder to track or reverse.

Why it works?

Scammers use a gradual, step-by-step approach to lure victims in, making small requests at first and escalating them over time.

Victims often don’t realize they’re being scammed until they’ve already lost significant money. The offer of “easy money” and small, seemingly reasonable steps trap victims in a cycle of payments that eventually lead to major financial loss.

According to a report by the Federal Trade Commission (FTC), in the first two quarters of 2024, business and job opportunities resulted in a $170 million loss, with a median $ loss of $2000 per victim.

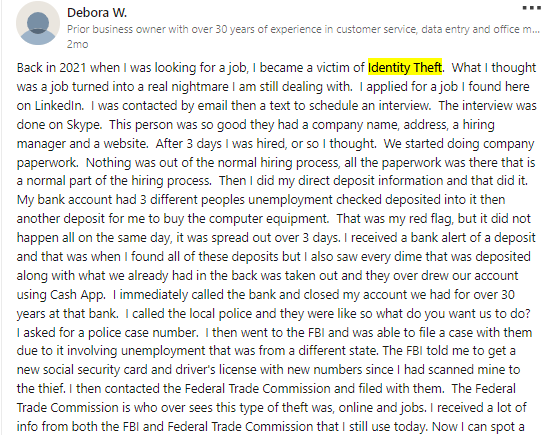

Identity theft

Identity theft remains a major risk of job scams. When victims provide sensitive personal information, such as Social Security numbers or bank account details, it can be exploited for financial gain or used for other fraudulent purposes (impersonation, medical, etc).

This was the case with Debora, who was scammed into providing her direct deposit details and ultimately becoming a victim of identity theft.

Her bank account was used for fraudulent deposits, and she had to contact the Federal Trade Commission (FTC) and the FBI for help.

If you want to learn more about preventing identity theft or about online impersonation, check out the following resources:

Early detection or no harm

Some individuals noticed inconsistencies in job offers allowing them to back out before losing money or sharing personal information.

Others researched companies, checked email addresses or contacted the employers directly, spotting scam early on.

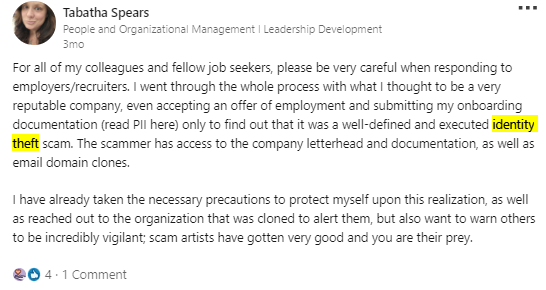

For example, Tabatha narrowly avoided identity theft by catching that the company she was dealing with had cloned legitimate documents and email domains. This early awareness saved her from a major scam.

Albert Kim, VP of Talent at Checkr, explains, the damage is often worse than financial loss.

Job scams affect victims’ finances, so there’s that initial pain of financial loss. What comes next can be even more devastating because victims feel embarrassed, ashamed, and violated.

Getting hit by a job scam can make you question your intelligence and value as a candidate—especially if you’ve faced a lot of rejection through your search.

8. What emotional impacts do victims face?

Key takeaway: Job scams leave many victims feeling distressed, angry, and anxious, showing the deep emotional toll these scams take.

Developing strong support systems and raising awareness about the emotional effects can help people cope with these challenges.

Our analysis shows that:

- 61% of victims experienced distress,

- 51% felt anger,

- 41% suffered from anxiety,

- and 10.20% had other emotional responses.

Emotional responses to job scams

Distress (35.29%)

Many victims express distress after being scammed. The psychological impact often extends beyond financial loss, leaving victims feeling betrayed, anxious, and emotionally drained.

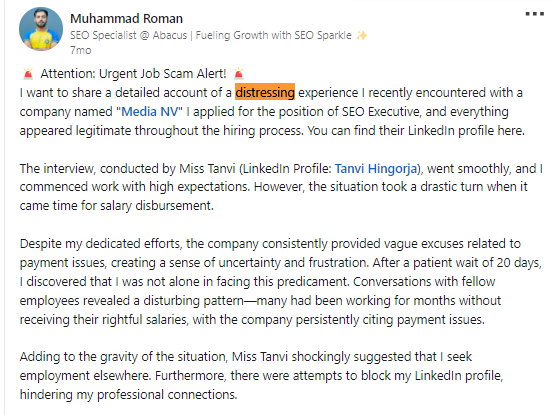

For example, Muhammad shared his distressing experience of a scam where promises of a legitimate job quickly dissolved when salary payments were consistently delayed.

The emotional strain escalated as the scam became more evident. Ultimately, Muhammad has lost not only his income but also trust in the professional platforms he used to find jobs.

Anger (29.41%)

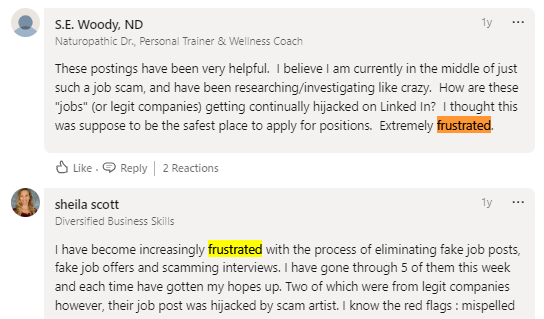

Victims often feel anger and frustration, reflecting their sense of betrayal and disappointment.

For instance, S.E. Woody and Sheila both shared their frustrations with fake job listings on LinkedIn, emphasizing how emotionally draining it was to be scammed after multiple job applications.

They expected LinkedIn, a professional networking platform, to be a secure place to find legitimate opportunities. The violation of that trust leads to anger and disappointment in both the platform and the process.

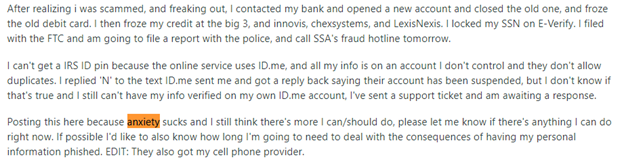

Anxiety (23.53%)

Anxiety and fear are other common emotional responses, reflecting the ongoing psychological stress victims endure.

For example, one Reddit user explained their anxiety after realizing they had been phished, fearing the long-term consequences of having their personal information stolen.

They described the panic of trying to freeze their credit, contact banks, and file reports with the FTC. This type of reaction shows how anxiety over potential long-term consequences, like credit damage or identity theft, can take a toll on victims’ mental health.

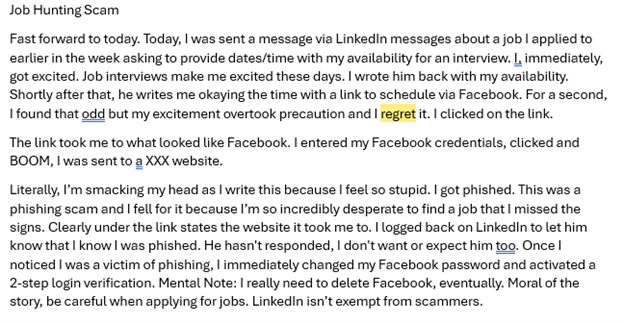

Other emotional responses (11.76%)

Some victims experienced other emotions, such as regret, confusion, or shock.

For instance, a LinkedIn user shared how excitement over a potential job opportunity led them to overlook obvious red flags, such as the suspicious nature of the request to schedule an interview through Facebook.

In their eagerness to secure employment, they clicked on a phishing link and entered their credentials, which led to their Facebook account being compromised.

The victim’s emotions shifted from excitement to deep regret, as they realized the error too late.

The frequency of these negative feelings shows that job scams come at a human cost – the victims’ mental health and overall well-being.

As per VeryWell Mind, the psychological effects extend beyond the scam itself, leading to feelings of guilt and self-blame. Victims often question their own judgment, which can lead to social withdrawal and further emotional turmoil.

“There is a stigma associated with being scammed, and [it] can make people hesitant to share their emotional struggles. This makes the emotional fallout become overlooked because it isn’t talked about,” says Dr. Holly Schiff.

To help manage these emotional impacts, Verywell Mind suggests a number of coping strategies, such as seeking therapy, talking to trusted individuals, and engaging in self-care to mitigate emotional distress.

Oliver Morrisey, Estate Lawyer and Owner & Director at Empower Wills & Estate Lawyers, explains the complexity of emotions victims often face:

The emotional toll on the victims of these job scams is far more destructive than many realize. Beyond the obvious frustration and anger, there’s a betrayal that cuts into one’s self-worth.

Many victims, particularly those who have spent years building their careers, experience a personal violation, as their hard-earned expertise and experience are used against them.

Imagine being someone who has climbed the corporate ladder, only to be duped into a scam where your own professional credentials are used to bait you.

It’s not about losing money—it’s the loss of identity, where victims start to question their professional value and decision-making capabilities.

In the long term, the consequences can ripple into every facet of life. Victims carry an unshakable sense of paranoia, especially around trust in any future job opportunities or professional networks.

9. What are the key red flags?

Key takeaway: Job scams are often riddled with red flags like upfront payment demands, phishing attempts, and requests for confidential information. Spotting these warning signs early can protect you from financial loss and identity theft.

Remember: If a job offer skips interviews, requires fees, or asks for sensitive personal details—proceed with caution. These are clear signs of a potential scam.

Our analysis revealed that the most common red flags that victims encountered were:

- Upfront payment: 25.08%

- Phishing attempts: 18.81%

- Requests for confidential information: 17.49%

- No interview: 15.84%

- Fake job offers: 12.21%

- Poorly written job descriptions: 10.56%

Upfront payment requests (25.08%)

Upfront payment demands are a clear red flag in job scams. Legitimate employers rarely, if ever, require candidates to pay money before securing a job.

Scammers often frame these requests as fees for training programs, certifications, or necessary work equipment, which can sound convincing to eager job seekers.

For instance, a Reddit user shared how he was asked to pay for training before being hired by a software company. This practice of demanding money before offering a job preys on individuals eager to secure employment, making it one of the most common tactics used in job fraud.

Phishing attempts (18.81%)

Phishing attempts were identified in 18.81% of the analyzed posts. Scammers often send fake job offers through phishing emails to steal confidential information, such as Social Security numbers or banking details.

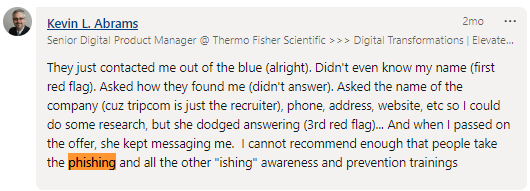

For instance, Kevin shared an experience where he was contacted out of the blue by a recruiter. Several red flags appeared, such as the recruiter avoiding basic questions about the company’s details and persisting even after Kevin declined the offer.

Recognizing these signs, he noted how important it is for job seekers to be aware of phishing and undergo prevention training. His proactive approach likely prevented further damage.

Why it works

Phishing succeeds by creating a sense of opportunity, which clouds judgment and makes victims act quickly. Job seekers are especially vulnerable as they may feel eager to respond to what appears to be an employment opportunity.

Scammers enhance the deception by using the names of well-known companies, adding an illusion of legitimacy.

With the rise of generative AI, phishing has become more sophisticated, producing convincing emails that lack the usual red flags like spelling errors or awkward language, making them even harder to detect.

This development has increased phishing attempts with 1,265% since 2022, as per InfoSecurity Magazine.

“The rise of GenAI has indeed contributed to an increase in the quality and variety of phishing emails, making them more difficult to detect. I’m especially worried about how it can now analyze and exploit personal vulnerabilities and emotions, making the emails seem more convincing.”, said Marlena-Adelina Deaconu, Heimdal®’s MXDR (SOC) Team Lead.

Check out the following articles if you want to learn more about how phishing works and how AI makes it so hard to detect:

- Phishing attacks explained: How it works, Types, Prevention and Statistics

- There’s Something Phishy About Generative AI

Requests for confidential information (17.49%)

Requests for confidential information are one of the most concerning red flags, representing 17.49% of analyzed posts.

Scammers often request sensitive data such as Social Security numbers, banking details, or other personal documents under the guise of a job application process.

Common keywords associated with this tactic include “request for confidential information” and “personal details requested.” Many victims have shared that they were asked for sensitive data, which is not typical for legitimate job applications.

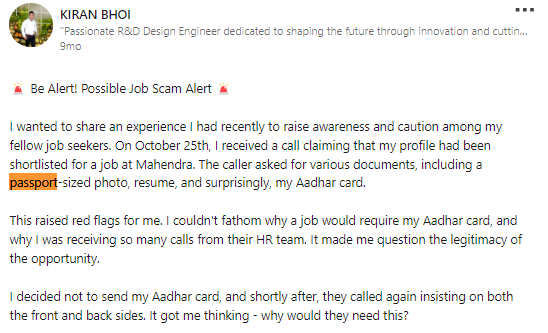

For example, Kiran shared how a scammer requested a passport-sized photo along with a surprising request for his Aadhar card (an identity document in India). This unusual request raised immediate red flags, especially as they insisted on receiving both the front and back of the card.

These scammers aim to use the confidential information they gather to commit identity theft or financial fraud, which is why is important to remain cautious when a potential employer asks for personal details without a valid reason.

According to a report by BBB Institute, online job scams often focus on stealing victims’ personally identifiable information (PII). The report found that 34% of victims had shared their driver’s license numbers, while 26% provided their Social Security or Social Insurance numbers (in Canada).

The FBI has also warned that scammers use PII for various fraudulent activities, such as taking over accounts, opening new financial accounts, or obtaining fake driver’s licenses and passports.

Job seekers must be cautious with sensitive information during the job search process. They should avoid including Social Security numbers, birth dates, or bank details on resumes posted online to reduce the risk of identity theft.

No interview (15.84%)

Legitimate companies almost always conduct interviews before hiring.

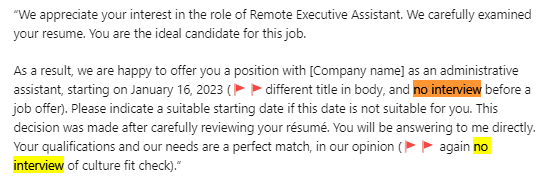

However, 15.84% of scam cases involve fraudulent offers without any interview process, as seen in the example shared by a user who received a job offer without ever speaking to a representative.

The job offer claimed to be based solely on the review of their résumé, but this type of process bypasses normal hiring protocols, which should always include a thorough interview stage.

The FTC also warns consumers not to fall for this trick: “Be suspicious if you’re offered a job without an interview. Scammers might say they’re out of town, too busy, or have another excuse for not talking to you by phone or in person.”

The takeaway? Always insist on an interview, and if a company offers you a position without one, consider it a red flag.

Fake job offers (12.21%)

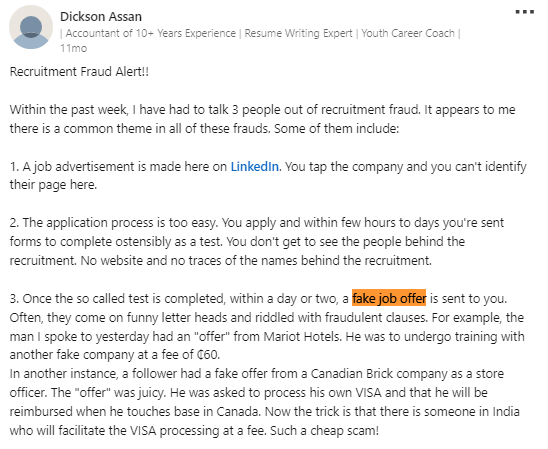

Fake job offers are a key red flag, with 12.21% of users who voiced their experienced with job scams on social media identifying this tactic.

Scammers use professional-looking documents and company names to make the offer appear genuine. Victims are often convinced by the quick and straightforward process, making them less likely to recognize the red flags before it’s too late.

In the example shared by Assan, he discussed how a man received a fake offer from “Mariot Hotels” that required him to undergo training with another fake company, for which he had to pay a fee.

Similarly, another individual was asked to pay for visa processing in a scam where the “offer” promised reimbursement once he arrived in Canada.

With advancements in technology, particularly the rise of generative AI, scammers have become more sophisticated in their tactics, making it increasingly difficult for job seekers to distinguish between legitimate and fraudulent job offers.

Valentin Rusu, Ph.D., Lead Machine Learning Engineer at Heimdal, explains:

Scammers have become incredibly sophisticated, especially with the rise of generative AI, which allows them to mimic real recruiters almost perfectly.

They prey on emotional vulnerabilities, making it harder than ever to differentiate genuine job offers from fake ones. It’s clear that job platforms are struggling to keep up with the growing number of scammers.

Poorly written job descriptions (10.56%)

Poorly written job descriptions are a clear red flag, indicating unprofessional and possibly fraudulent job postings.

Scammers often create vague, poorly constructed descriptions with multiple spelling and grammatical errors. Keywords like “poorly written,” “badly worded,” and “unprofessional” are frequently mentioned by victims.

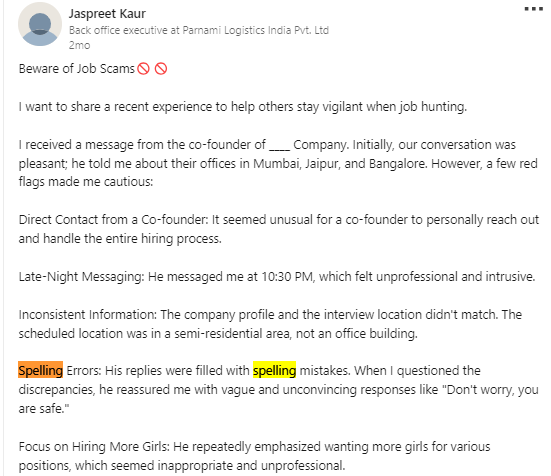

For example, Jaspreet shared an experience where the communication she received was filled with spelling mistakes and unconvincing responses.

The unprofessional language used, coupled with inconsistent information, pointed towards a fraudulent job offer.

These mistakes are uncommon in legitimate job postings, and they serve as a strong indicator of scams.

Jess Munday, Co-Founder and People & Culture Manager at Custom Neon, shares her take on job descriptions:

A common sign is a job description that’s very broad or overly simplistic, with little mention of specific skills or experience.

If the company is untraceable online or they use a personal email address rather than a business one, it’s advised to exercise caution.

Cache Merrill, Founder, CEO, and CTO of Zibtek, suggests:

Look for inconsistencies in the job description or unrealistic promises compared to other listed opportunities.

Look up industry salary averages—if there’s a big discrepancy, it’s likely too good to be true. They’re likely not legit if they add extra pressure for you to say yes quickly or communicate unprofessionally.

Look for unprofessional email addresses, suspicious-looking websites with misspelled URLs, and a limited or relatively “young” online presence. If this company’s Instagram posts only date back to a few days or weeks ago, they’ve likely slapped the content up in a hurry.

10. How to prevent job scams?

Key takeaway: Preventing job scams begins with simple steps—checking reviews, verifying company information, and consulting trusted friends. These measures significantly reduce your risk of falling for fraudulent job offers.

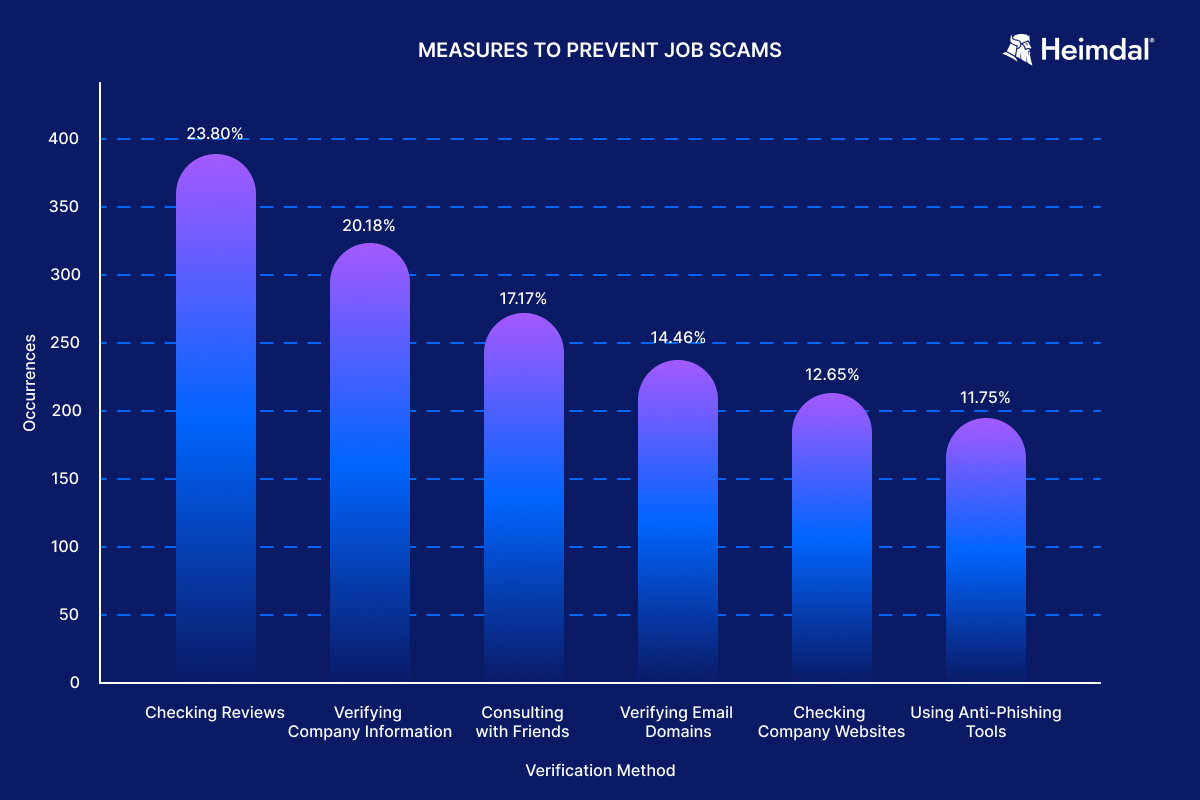

Our analysis reveals that the top preventive measures used by victims to avoid job scams include:

- Checking reviews: 23.80%

- Verifying company information: 20.18%

- Consulting with friends: 17.17%

- Verifying email domains: 14.46%

- Checking company websites: 12.65%

Checking reviews (23.80%)

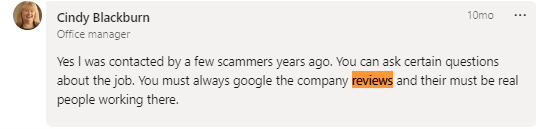

Checking reviews was frequently mentioned as a preventive measure.

It works because it provides real user feedback about the company, revealing red flags that aren’t obvious at first glance. Scam companies often lack legitimate reviews or show a pattern of negative feedback.

For example, Cindy emphasized the importance of Googling company reviews before accepting any offers, noting that a lack of real people associated with the company is a major warning sign.

A simple review check on platforms like Glassdoor or BBB can reveal whether the company has a trustworthy track record.

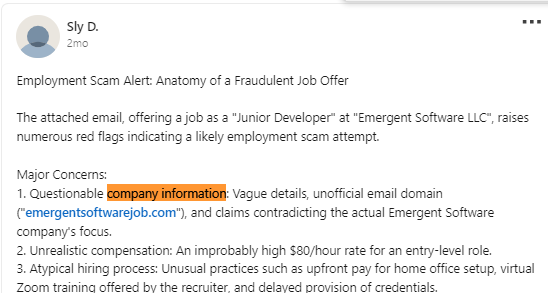

Verifying company information (20.18%)

Verifying company information is essential in confirming the authenticity of job postings.

Victims who verified company details often discovered discrepancies or fraudulent activity (20.18%).

Verifying details like business registration, office locations, and other company data can quickly expose inconsistencies. Scam companies often rely on vague or misleading information to appear legitimate.

As was the case with Sly, who shared on LinkedIn his experience with a job offer where the company’s information did not align with their claims—unofficial email domains and incorrect business focus were the key indicators.

Verifying through government business registries or cross-referencing LinkedIn can help you confirm legitimacy.

Government business registries

Many countries provide online databases where you can verify if a company is officially registered and recognized by government authorities.

These registries usually include important details like the company’s registration number, address, legal status, and date of incorporation.

For example: In the U.S., you can check through the SEC’s EDGAR database or a state business registry. In the U.K., Companies House provides similar information.

LinkedIn can be an excellent tool for cross-referencing employees, company presence, and job listings. Legitimate companies often have a LinkedIn business profile with real employees who have active profiles.

You can:

- Look at employee profiles to ensure they’re working in the positions they claim.

- Verify that the company’s LinkedIn page has regular activity, which includes posts, employee updates, and genuine interactions.

Rain Yang, CEO and HR leader at WoodenAve, offers a practical tip:

My top tip for spotting fraudulent job opportunities is to contact current HR employees to confirm whether the job opening is legitimate.

You can contact the company website, official social media channels, or LinkedIn profiles of current HR employees.

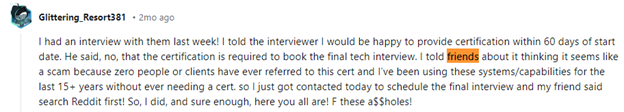

Consulting with friends (17.17%)

Victims often sought advice from friends or acquaintances, which helped them identify and avoid scams.

Seeking advice from friends and colleagues adds an extra layer of protection, as someone in your circle may spot a red flag you overlooked.

For instance, this Reddit user consulted with a friend who immediately recognized the red flags of a scam based on previous research, saving them from further interaction with the fraudulent company.

Personal networks offer firsthand experiences that can guide you toward or away from certain job offers.

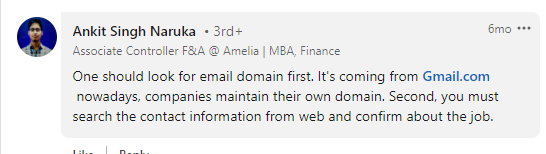

Verifying email domains (14.46%)

Verifying email domains is important to ensure communication is legitimate.

Victims who checked the email domains of job offers often found that the emails came from suspicious or unverified sources.

Scammers frequently use unofficial email domains (e.g., Gmail, Yahoo) or variations of company names to appear legitimate. Verifying the domain also helps identify phishing attempts.

For example, Ankit stressed the importance of checking email domains, as legitimate companies maintain their own official domains.

This simple check can often reveal if an email originates from a legitimate company or a fraudulent source.

Websites like ICANN Lookup allow you to look up the registration details of a domain, including who owns it, when it was created, and whether it’s linked to a legitimate company.

Checking company website (12.65%)

Checking company websites confirms the presence and legitimacy of the company.

Victims who visited the company websites from their fake job offer often found discrepancies or discovered that the company did not exist.

Legitimate companies have detailed, well-maintained websites. A lack of information or inconsistencies on a website can indicate a scam.

Take away? A quick visit to a company’s official website can either confirm its legitimacy or expose red flags.

Using anti-phishing tools (11.75%)

Some users mentioned that anti-phishing tools helped them block phishing emails, protecting personal and financial information.

Anti-phishing tools filter and block suspicious communications, reducing the risk of clicking malicious links or sharing sensitive information.

Tools like anti-phishing browser extensions or email filters can add an extra layer of security, especially for individuals frequently seeking jobs online.

Popular email services like Gmail and Microsoft Outlook have built-in protection against malicious messages, but for stronger defense, you might need to boost your spam filter.

If you’re looking for a solid anti-phishing tool, especially for company use, Heimdal’s AI-Powered Email Fraud Prevention tool is worth considering. It offers advanced protection by filtering out malicious attachments, suspicious links, and identifying phishing attempts in real-time.

Use the power of social media

Harnessing the power of social media can make a big impact in the fight against job scams. When victims share their experiences online, like in this study, it helps others identify scams faster.

Job seekers can easily search for a company’s name followed by “scam” to uncover red flags and avoid falling into the same trap. Communities on platforms like LinkedIn and Reddit become valuable resources for spreading awareness and keeping people safe.

Report to authorities

And report your experience to authorities to avoid the spread of fraud. In the U.S., victims can file complaints with the Federal Trade Commission (FTC), the Federal Bureau of Investigation (FBI), or the Better Business Bureau (BBB).

For those outside the U.S., it’s important to report scams to relevant national agencies, such as Action Fraud in the UK, the Canadian Anti-Fraud Centre, or their local consumer protection agency.

Other tips include:

- trying a “job scam simulation” exercise. Mary Zhang, Head of Marketing and Finance at DgtlInfra, explains this strategy:

An unconventional tactic we’ve employed is creating a ‘scam simulation’ as part of our onboarding process.

New hires go through a simulated job scam scenario, which has dramatically improved their ability to spot real-world attempts.

- if you’re a company and scammers are copying your job postings, it’s a good idea to add a ‘Scam Alert’ section to your website to fight back.

Kevin Shahnazari, Founder & CEO of FinlyWealth, a fintech firm, explains:

We now include a ‘Scam Alert’ section on our careers page. It lists our official hiring channels and emphasizes that we never charge application fees.

This simple addition led to 10 potential victims contacting us to verify suspicious offers last quarter.

Conclusion

In a nutshell, here are the Top Social Media Trends Around Job Scams:

- The most targeted job industries for scams are Finance and IT.

- Scammers are increasingly focusing on remote positions.

- Most job scams target leading roles, such as managers, and entry-level roles.

- Email and social media are the most common contact mediums for job scams.

- The top three job scam tactics are suspicious contact information, unrealistic salary offers, and misleading job descriptions.

- 45% of victims reported their scam to authorities, while 35% confronted the scammer.

- 55% of victims experienced financial loss, and 21% faced identity theft.

- Job scams are affecting well-being, as victims expressed strong negative emotions such as distress, anxiety, anger, and helplessness.

- The biggest red flags: upfront payments, phishing, and requests for confidential info.

- The top tips for preventing job scams are: checking reviews, verifying company information, and consulting with friends.

Methodology

Finally, I want to extend my gratitude to our team for their efforts in collecting and analyzing the data. Their hard work and commitment made this study possible.

Here’s a link to our study methodology.

Now, it’s over to you: What’s your top insight from this job scams study?

- Have you ever encountered a job scam? If so, what gave it away? Your story could help others spot the red flags faster.

- Have you noticed any new scam tactics not covered in this report?

- What measures would you like to see social media and job board platforms implement to prevent job scams?

We’d love to hear your thoughts. Join the conversation on LinkedIn or X or feel free to reach out to us directly. Your insights could help others stay safe from job scams.

Network Security

Network Security

Vulnerability Management

Vulnerability Management

Privileged Access Management

Privileged Access Management  Endpoint Security

Endpoint Security

Threat Hunting

Threat Hunting

Unified Endpoint Management

Unified Endpoint Management

Email & Collaboration Security

Email & Collaboration Security