Contents:

Social engineering in cybersecurity is a dangerous technique – it requires human interaction and manipulation for hackers to successfully access confidential information and networks. The various types of online financial frauds launched by malicious actors represent a highly effective form of this phenomenon. Let’s find out more!

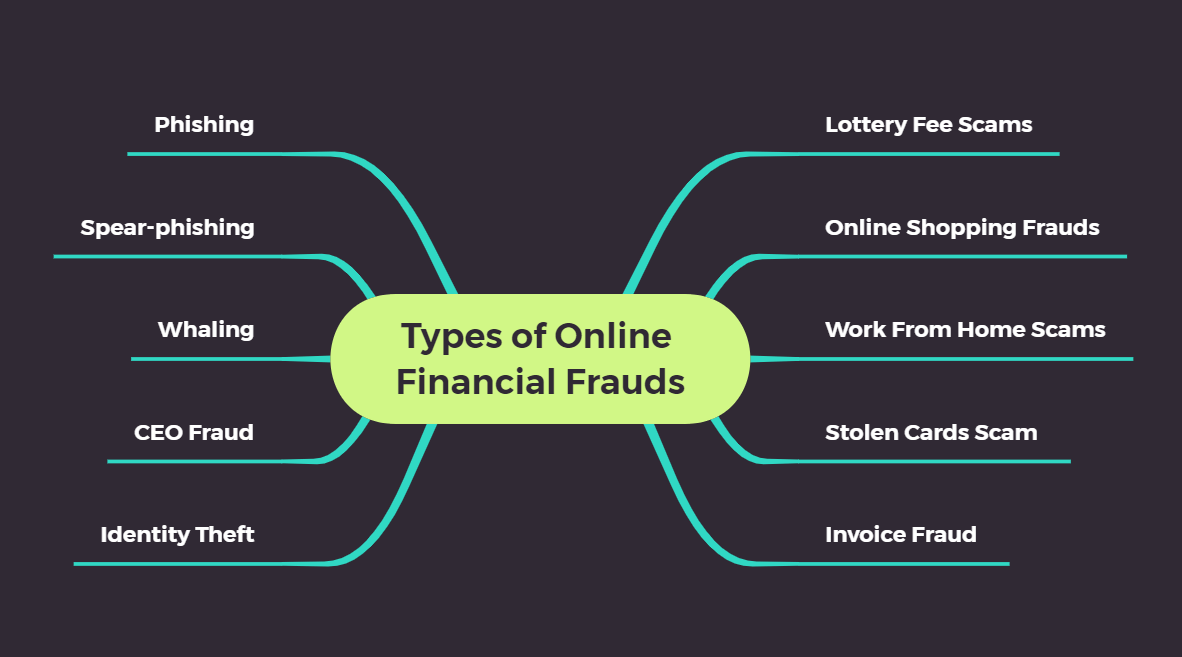

Types of Online Financial Frauds

As Investopedia writes, “financial fraud occurs when someone takes money or other assets from you through deception or criminal activity.” As the National Crime Victim Law Institute notes, “fraud that is committed using the internet is <<online fraud>>. Online fraud can involve financial fraud and identity theft.” Ergo, an online financial fraud represents a financial fraud undertaken using the cyberspace.

When it comes to examples, there are multiple types of online financial fraud launched by cybercriminals waiting for their new victims.

The most common? Phishing, CEO fraud, spear-phishing/whaling, identity theft, lottery fee scam, online shopping frauds, work from home scam, stolen cards scam, invoice fraud.

1) Phishing represents “a malicious technique used by cybercriminals to gather sensitive information (credit card data, usernames and passwords, etc.) from users. The attackers pretend to be a trustworthy entity to bait the victims into trusting them and revealing their confidential data.”

2) Spear-phishing is a subset of phishing “that aims to extract sensitive data from a victim using a very specific and personalized message. This message is usually sent to individuals or companies, and it’s extremely effective because it’s very well planned.”

3) Whaling is similar to spear-phishing – the difference is that whaling “goes after high-profile, famous and wealthy targets, such as celebrities, CEO’s, top-level management and other powerful or rich individuals.”

4) As you can expect from the previously mentioned types of online financial frauds, CEO fraud also implicates “the big fish”. In this type of attack, unlike whaling, though, the malicious actors pretend to be the CEO of the company you work for or another authority figure and ask victims to send money or give them access to sensitive information.

5) In the case of identity theft, “fraudsters target personal information, such as names, addresses and email addresses, as well as credit card or account information. This enables them, for example, to order items online under a false name and pay using someone else’s credit card information or by debiting another person’s account.“

The following occurrences are usually a sign that you deal with identity theft:

- you notice unknown/unexpected withdrawals from your bank accounts

- you no longer receive bills or financial statements you usually get on the email

- you receive calls from debt collectors asking you about unknown credit cards or debts

6) With lottery fee scams, “You will receive notification that you have won a lot of money or a fantastic prize in a competition […] you don’t remember entering. The contact may come by mail, telephone, email, text message or social media. The prize you have ‘won’ could be anything from a tropical holiday to electronic equipment such as a laptop or a smartphone, or even money from an international lottery. To claim your prize, you will be asked to pay a fee. Scammers will often say these fees are for insurance costs, government taxes, bank fees or courier charges.”

7) Online shopping frauds made lots of victims in the past few years. They imply the set up of fake online shopping portals where fraudsters display products at a very attractive price. Once the purchase is made, the client/victim receives a fake product or no product at all. Also, on these websites, there is little to no information about return or refund policies, nor customer support team to contact.

8) Work from home scams are particularly dangerous in these times, when, due to the Covid-19 pandemic, many people are looking for a job and would prefer to find a work from home position. In this type of fraud, “fraudsters dupe people who are looking for work from home opportunities by promising that they will earn handsome money, just by working for a few hours from home. To register for the scheme, job seekers will be asked to deposit a certain amount of money for job kit which is useful for the work. After the money is deposited, there will be no track of employers.”

9) Stolen cards scam involves the use of stolen credit or card details. Fraudsters usually steal the cardholder’s information using some online scam and then proceed with making online purchases.

10) Invoice fraud targets “businesses by impersonating a supplier, usually via email, asking to update the bank details invoices are paid into. This might look entirely innocent if the fraudster has hacked the supplier’s info, as the request will appear to be authentic.”

Types of Online Financial Frauds – Prevention

When it comes to avoiding the multiple types of online financial frauds that malicious actors arrange, prevention plays a huge role.

You should, first of all, learn about what you are up against and, secondly, train your employees. All of them should be careful too.

Then, there are some other measures you can take:

- Regularly scan your computer for spyware. Spyware and adware programs check your Web activity and share it with malicious actors.

- Ba careful with your passwords – make them strong, change them regularly, and enable multi-factor authentication whenever possible.

- Install a powerful antivirus solution and keep it updated.

Our Heimdal™ Next-gen Endpoint Antivirus uses signature-based code scanning to monitor the activity of your company’s files in order to protect your endpoints against various threats. The solution is effective and easy to use, its Unified Threat Dashboard of the Heimdal™ agent offering enhanced visibility, global scalability and on-the-fly deployment and updates.

- Protect your email accounts. Since many of the types of online financial frauds we’ve talked about involve email communication, this part cannot be neglected.

Choose a solution that can prevent malware, stop spam, malicious URLs and phishing, with simple integration and highly customizable control. Our Heimdal™ Fraud Prevention module can help you detect CEO and financial mail fraud, spot Insider Business Email Compromise, discover imposter threats, but also advanced malware emails by using 125 detection vectors to keep your email safe. These vectors include phraseology changes, IBAN / account number scanning, attachment modification, link execution and scanning, man-in-the-email detection.

Heimdal® Email Fraud Prevention

- Advanced email fraud prevention solution focusing on email alterations

- 125 vectors of analysis coupled with live threat intelligence

- Deep content scanning for attachments and links;

- Identify and stop Business Email Compromise, CEO Fraud, and complex malware

Also, if you have encountered one or more types of online financial frauds, you may consider reporting it. You can find more information about this on the USA GOV website and in one of our previous articles.

Types of Online Financial Frauds – Wrapping Up

If something is too good to be true, your intuition is probably right. If you have to pay for it, it’s not a real win or opportunity. Always remember this and take preventive measures in order to avoid interacting with malicious actors and the types of online financial frauds they set the scene for.

Also, please remember that Heimdal™ Security always has your back and that our team is here to help you protect your home and your company and to create a cybersecurity culture to the benefit of anyone who wants to learn more about it.

Drop a line below if you have any comments, questions or suggestions – we are all ears and can’t wait to hear your opinion!

Network Security

Network Security

Vulnerability Management

Vulnerability Management

Privileged Access Management

Privileged Access Management

Endpoint Security

Endpoint Security

Threat Hunting

Threat Hunting

Unified Endpoint Management

Unified Endpoint Management

Email & Collaboration Security

Email & Collaboration Security