Contents:

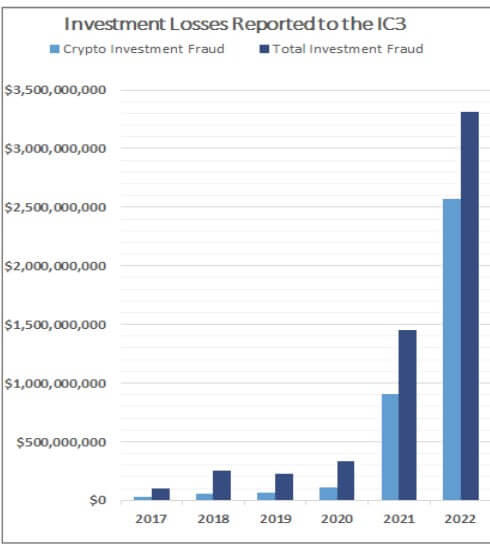

According to the FBI’s annual Internet Crime Report, investment fraud was the most common kind of internet criminal activity in 2022. The $3.3 billion paid by victims increased from $1.45 billion in 2021, which is a 127% jump.

The report started in May 2000 and is one of the most significant sources of information in the cybercrime world. The information is gathered from the FBI’s Internet Crime Complaint Center (IC3), a website where victims of cybercrime can file an incident.

Internet Crime Report in Numbers

Investment scams surpassed business email compromise (BEC) attacks that were responsible for $2.7 billion in losses last year. These two are followed by tech support scams and personal data breaches.

Investment fraud and BEC together sum up more than half of the 2022 cybercrime-related losses, the Internet Crime Report shows. The numbers are up to billions of dollars, meanwhile, the other types of online crimes reached millions.

For example, phishing attacks caused a total of $52 million in losses. Last year ransomware reached $34.3 million, credit card fraud $264 million, and identity theft $189 million.

While the number of reported ransomware incidents has decreased, we know not everyone who has experienced a ransomware incident has reported to the IC3. As such, we assess ransomware remains a serious threat to the public and to our economy.

In 2022 victims filed more than 800,000 cybercrime incidents, which is 5% lower than in 2021. Most of the individuals filing a crime are aged 30-49. Additionally, over the past year, the possible total loss has increased from $6.9 billion to over $10.2 billion.

How Investment Fraud Works

To put up an investment scam, threat actors usually impersonate the investment sites of well-known brands. This way they trick people into giving money for what they think is a good opportunity. The next thing that happens is that cybercriminals run with the victim’s money. Criminals are difficult to catch as many payments are made in cryptocurrency.

Crypto-investment scams saw unprecedented increases in the number of victims and the dollar losses to these investors. Many victims have assumed massive debt to cover losses from these fraudulent investments.

The agency’s Internet Crime Report also warns about different forms of investment scams. One of them involves threat actors hacking a social media account and proposing fake investment opportunities to the victim’s friends.

In another variant, hackers impersonate celebrities or rich real-estate buyers to convince people to invest. And in the case of employment fraud, individuals apply for fake jobs at investment firms. Instead of jobs, the applicants receive fake investment advice meant to steal their money.

If you liked this article, follow us on LinkedIn, Twitter, Facebook, and YouTube for more cybersecurity news and topics.

Network Security

Network Security

Vulnerability Management

Vulnerability Management

Privileged Access Management

Privileged Access Management  Endpoint Security

Endpoint Security

Threat Hunting

Threat Hunting

Unified Endpoint Management

Unified Endpoint Management

Email & Collaboration Security

Email & Collaboration Security