Contents:

Cyber insurance in 2025 showed slowing market growth, fewer overall claims, and rising attack severity—signaling a maturing but increasingly high-stakes landscape. As premiums climb again and ransomware continues to dominate losses in 2026, these trends will shape how businesses recalibrate their risk strategies and determine the true value of coverage in the year ahead.

Investing in cyber insurance is a smart move. In case of a cyber attack, it can reduce the financial burden of a breach and give businesses (and individuals) peace of mind.

Advanced cybersecurity software should always be the first line of defence against attacks. It’s far cheaper than paying an excess if you do get hacked and can prevent business disruption. Nonetheless, cyber insurance is a valuable backup. Even the best defences can be breached by determined criminals, so insurance is always worth having.

We generally recommend our customers use cyber insurance, so keeping an eye on the market became a habit. For this article, I read several industry reports, government publications and academic studies to understand the state of the sector. I’ll now share my findings with you.

Key 2025 cybersecurity insurance statistics at a glance

Here are the most important cybersecurity insurance statistics for 2025:

- The number of cyber insurance claims decreased overall in 2025 – by around 50%

- The average value of a claim was $115,000

- Ransomware is the key driver of cyber insurance claims, accounting for 60% of large claims

- Manufacturing firms made most cyber insurance claims – 33% of the total

- The cyber insurance market is worth $20.56 billion in 2025

- More firms are now covered – 62% have a cyber insurance policy in 2025, compared to 49% in 2024

The cyber insurance market is growing – but slowing

In 2025, the global cyber insurance industry is worth US $20.56 billion, according to Research and Markets. The market is expected to continue growing, reaching nearly $30 billion by 2030, according to Allianz.

Further on, a UK government survey found a significant increase in the number of businesses taking out a cyber insurance policy in the past 12 months. In 2025, 62% had some kind of cyber insurance, compared to 49% in 2024.

However, the market is also starting to slow. Insurer SwissRe notes that the market only grew by about 5% CAGR between 2022 and 2025. That’s a really small figure compared with the 31% growth that took place between 2017 and 2022.

This slowdown is surely due to market maturation – with more firms already insured, the market can’t expand as fast. This shift has created something of a buyer’s market, with premiums 6% lower in 2025 than the year before, and 22% down from the peak in 2022 (per SwissRe).

That being said, insurance premiums are set to rise again in 2026, according to S&P Global Ratings – they forecast a 15-20% increase next year.

Who has cyber insurance in 2025?

Statistics paint an interesting picture of the takeup of cyber insurance this year.

According to SwissRe, 60-70% of large corporates (revenue $1bn +) buy cyber insurance, 40-50% of mid-market firms have it (revenue $100m – $1bn), while only 10-20% of SMEs ($10-100m) and 5-10% of micro businesses (below $10m) have this kind of policy.

However, this is somewhat contradicted by the UK government survey which found that 62% of small businesses have cyber insurance as do 65% of medium businesses, but only 53% of large businesses do. One hypothesis is that larger businesses have the internal skills to defend themselves against cyber attacks, so don’t feel as strong a need to invest in insurance.

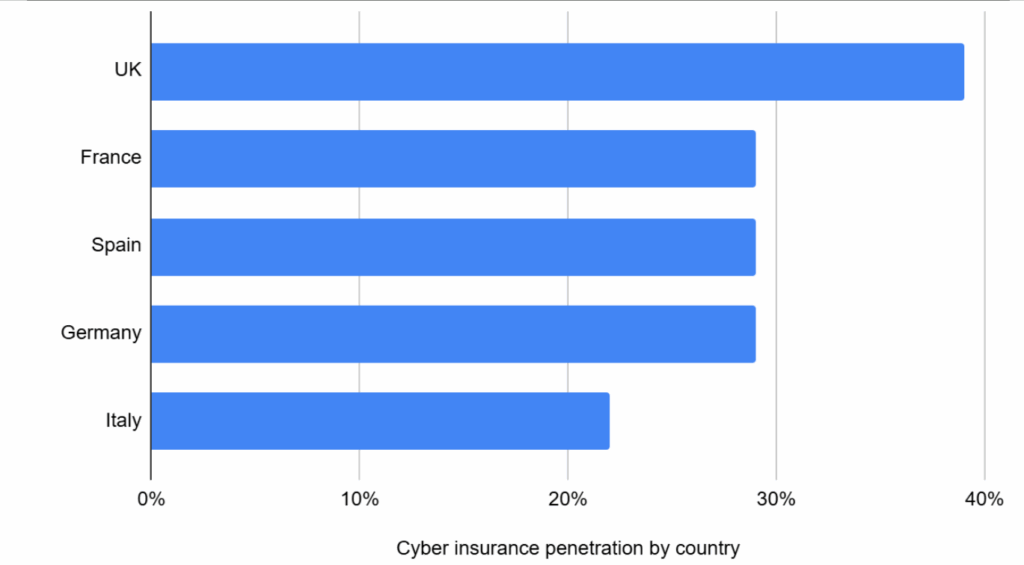

Meanwhile, Howden, an insurer, has estimated cyber insurance penetration in a handful of major European economies:

One possible reason cyber insurance is more widespread in the UK is because the country is also a top target for cyber criminals – as our rundown of UK cybersecurity statistics shows.

Cyber insurance statistics show fewer claims in 2025

One big positive this year has been a decline in the number of cyber insurance claims made. Allianz report that their customers’ claim severity declined by more than 50% in the first half of 2025. Furthermore, the frequency of large loss claims (over €1 million) dropped by 30%.

This mirrors data from US insurer CyberResilience, who reported that claims in their portfolio also dropped by 53% in the first half of 2025. Meanwhile, Coalition, another insurer, reported a smaller claim frequency decrease of 7%.

However, there is a fly in the ointment. CyberResilience report that claims for successful attacks are 17% higher than in 2024, suggesting criminals are causing more carnage when they do get in.

The cost of cyber insurance claims in 2025

How much are businesses claiming on their insurance when they do get breached? The numbers vary depending on a few factors.

Coalition, an insurer, reports a headline figure of $115,000 on average for all global claims. This was roughly in line with 2024 figures. However, NetIntelligence, another insurer, says the average incident cost in 2025 was a much higher $264k.

2025 cyber insurance claims by select countries

Claims varied somewhat by region, with Coalition’s data showing:

- US claims came to $108,000 on average

- Canadian claims were especially high – $226,000 on average

- UK claims were much lower – working out at $35,000 on average

2025 cyber insurance claims by business size

Coalition also break down cybersecurity insurance claim severity by business size in 2025:

- Claims by small businesses were for $79,000 on average

- Claims for medium businesses were $139,000 on average

- And claims by large businesses were for $228,000 on average

2025 cyber insurance claims by industry

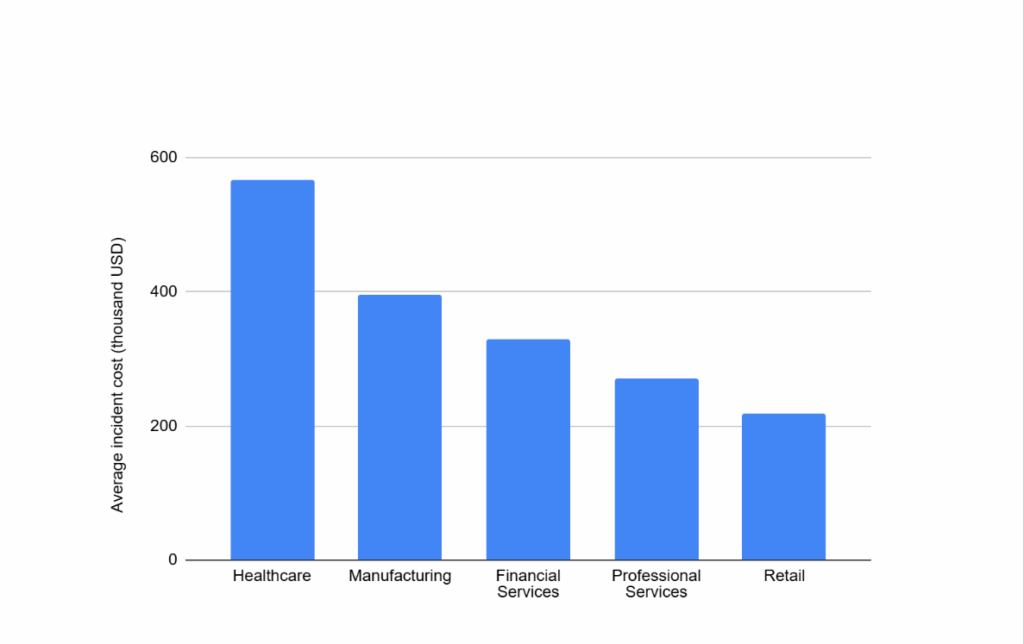

NetDiligence, another insurer, released data about the value of claims they received in 2025 by select industries. This shows that insurance claims by healthcare and manufacturing are the most costly:

2025 cyber insurance claims by attack method

NetDiligence also report on the cost of claims, depending on the type of attack:

- Ransomware: $631,000

- Wire transfer fraud: $171,000

- Hacking: $135,000

- Business email compromise: $98,000

- Theft of money: $38,000

Clearly, ransomware leads to the highest value insurance claims by far.

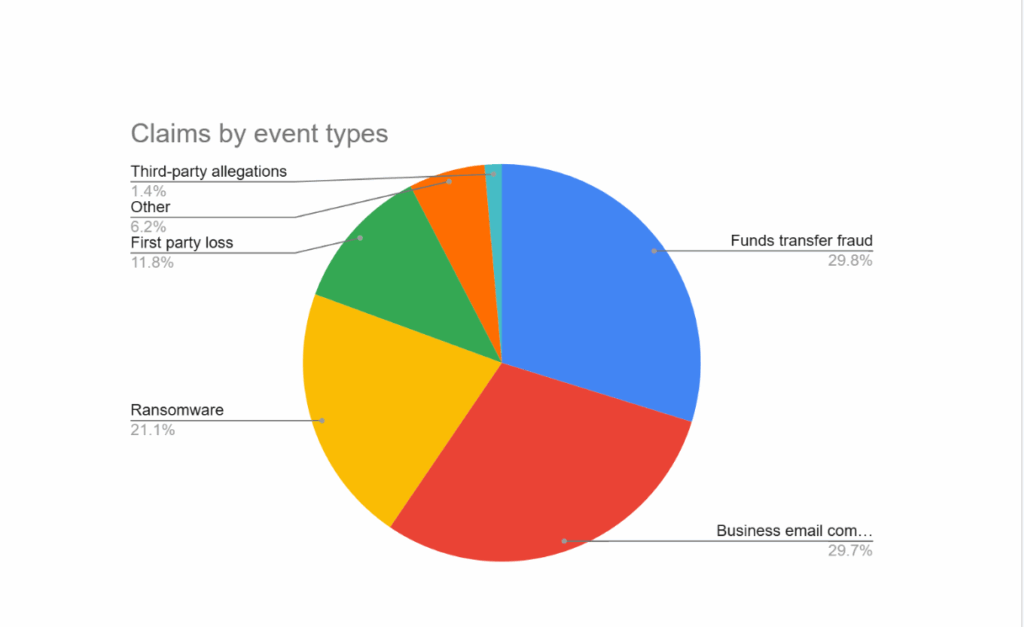

Which types of cyber attack trigger most claims?

There are many methods that cyber criminals use to attack businesses. But which ones lead to most claims?

According to Allianz, ransomware accounts for 60% of the value of large claims (those over €1 million). The other 40% of large claims are related to data theft.

For smaller claims, there’s more of an even spread between different methods of attack, according to Coalition’s figures:

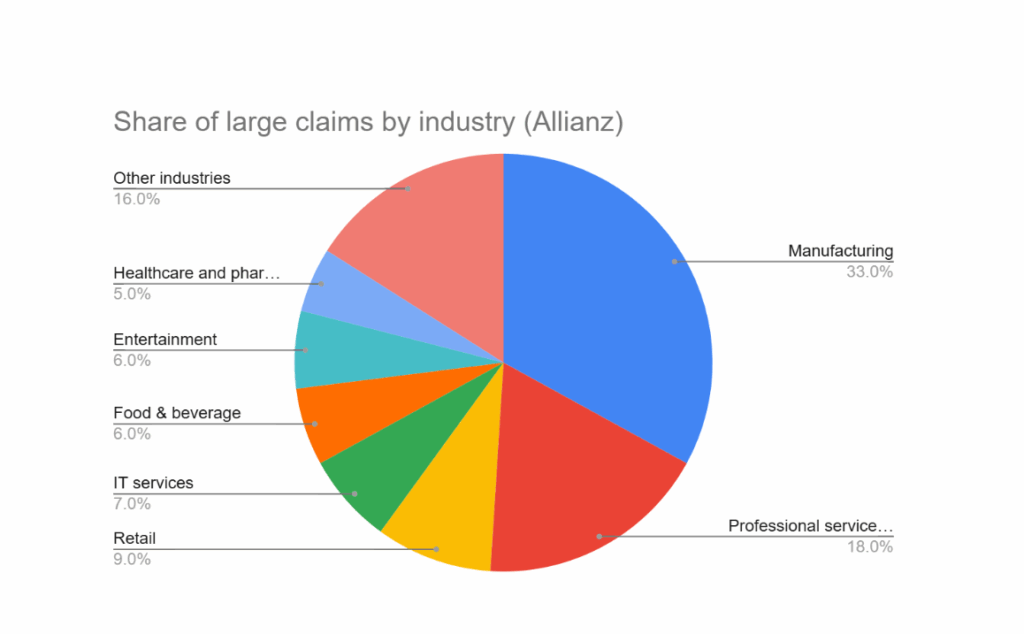

Who is making most cyber insurance claims?

Statistics show some interesting trends in the kinds of organisations making cyber insurance claims.

According to Allianz, the manufacturing industry made the most claims in 2025, representing 33% of the total. This is no surprise – as we noted in our guide to cybersecurity in manufacturing, there was a 71% increase in attacks against the sector last year. It follows that the sector is making more claims.

Professional services and consulting firms made 18% of large cyber insurance claims, while the spread is more even among other industries:

Statistics highlight cyber insurance benefits in 2025

Unsure if you really need cyber insurance? At Heimdal, we’d generally recommend it, although it ultimately depends on your risk appetite.

The insurance industry has (unsurprisingly) produced reports and statistics that highlight the benefits. While you’ll have to judge for yourself, these figures might just convince you.

Calculations by insurer Howden in 2025 estimate that cyber insurance has an ROI of 19%. This is based on the assumption that a business generating €500 million in annual revenue will save €16 million in attack related costs over a decade if they take out cover.

Meanwhile, Allianz reckon that cyber insured companies are more resilient than firms that go without. They estimate that, in the past four years, cyber insured companies have seen loss impacts rise by 70%, compared to 250% for non-insured companies.

You’ll still lose some money from cybercrime if you’re insured, but much less than if you go without.

One explanation here is that companies who get cyber insurance are also more likely to invest in their defences. A January 2025 World Economic Forum report found that only 7% of highly cyber resilient businesses don’t have cyber insurance.

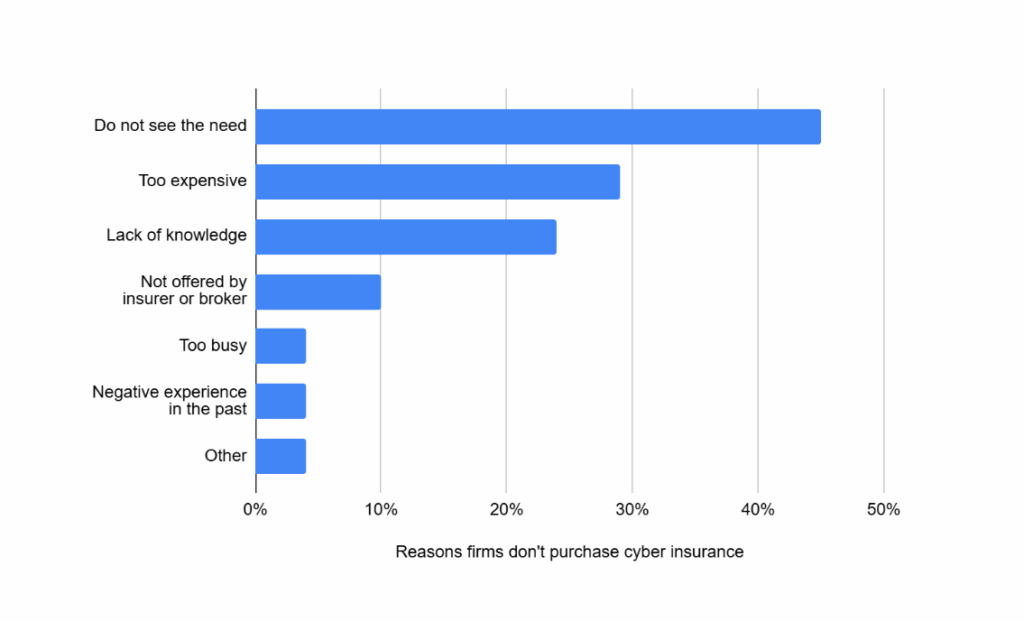

Why do some companies not get cyber insurance?

While cyber insurance has clear benefits, many firms still avoid buying it. According to Howden, the top reasons firms choose not to take out policies are:

Cyber insurance and individuals

While cyber insurance is mainly purchased by companies, charities and other organisations, statistics also show there is a market among private individuals too.

In one survey in the US, 66% of adults said they were familiar with cyber insurance. However a 2023 survey found that only 6% of people had taken out a personal cyber policy.

One possible reason for low uptake among private individuals is that relatively few home insurance policies cover cyber crime. An academic study published in 2025 found that most home insurance policies either exclude cyber threats or are ambiguous about whether or not policyholders are covered.

Cyber insurance as part of your strategy

A robust cybersecurity platform will dramatically reduce your chances of being breached. However, no defense is bulletproof, so in case attackers do find a way in, a cyber insurance policy might save your business.

As these 2025 cyber insurance statistics show, companies that tend to invest in cyber insurance also tend to have higher levels of cyber resilience. This suggests there’s a virtuous circle. Investing in insurance encourages companies to also invest in their defences.

To learn about how our cyber security solutions can protect your most valuable data – and work alongside your cyber insurance policy – contact us today.

If you liked this article, follow us on LinkedIn, Reddit, X, Facebook, and Youtube.

Network Security

Network Security

Vulnerability Management

Vulnerability Management

Privileged Access Management

Privileged Access Management  Endpoint Security

Endpoint Security

Threat Hunting

Threat Hunting

Unified Endpoint Management

Unified Endpoint Management

Email & Collaboration Security

Email & Collaboration Security