Contents:

The Criminal Investigative Division of the FBI and the Securities and Exchange Commission (SEC) are warning investors about an ongoing imposter scheme in which fraudsters are apparently impersonating investment professionals.

The warning was issued in collaboration with the SEC’s Office of Investor Education and Advocacy (OIEA) which is the SEC department in charge of helping individual investors protect themselves from securities fraud or abuse.

The end goal of this imposter scheme is to lure the targets into investment scams by making use of spoofed sites, fake social media profiles, cold calling, and other nefarious ways.

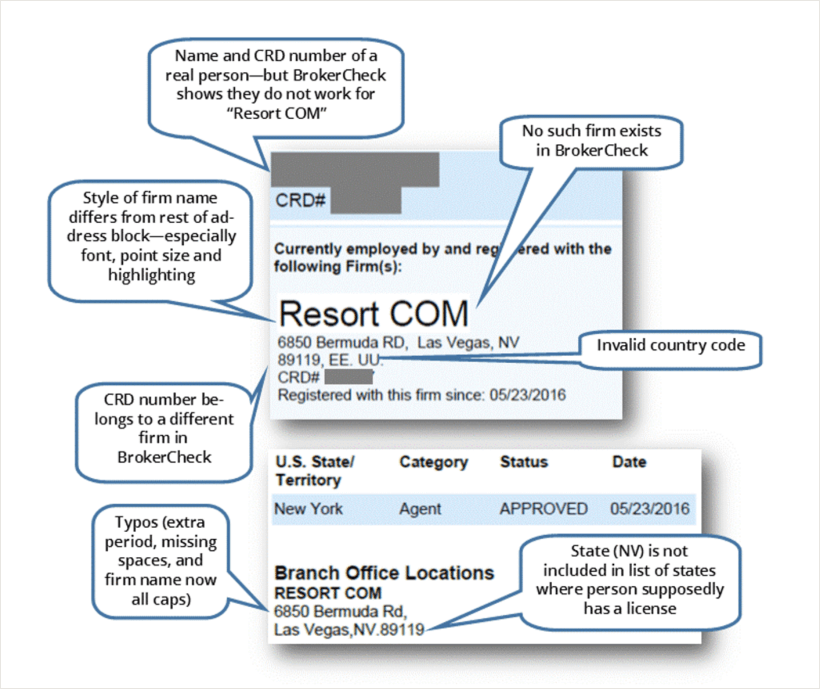

Fraudsters may falsely claim to be registered with the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) or a state securities regulator in order to lure investors into scams, or even impersonate real investment professionals who actually are registered with these organizations.

Fraudsters may misappropriate the name, address, registration number, logo, photo, or website likeness of a currently or previously registered firm or investment professional.

This is not the first fraud alert we’ve seen lately as just back in June a similar fraud alert was issued by FINRA regarding broker imposter scams using phishing sites that were pretending to be real brokers and created fake SEC and FINRA registration documents.

Investors should make sure to check if the person reaching out with investment opportunities is licensed or registered with the Investor.gov search tool and confirm they’re not a scammer.

It is extremely important that the investors always check for the following warning signs of an investment scam according to BleepingComputer.

- Guaranteed high investment returns: Promises of high investment returns – often accompanied by a guarantee of little or no risk – is a classic sign of fraud. Every investment has risk, and the potential for high returns usually comes with high risk.

- Unsolicited offers: Unsolicited offers (you didn’t ask for it and don’t know the sender) to earn investment returns that seem “too good to be true” may be part of a scam.

- Red flags in payment methods for investments: credit cards, digital asset wallets and “cryptocurrencies,” wire transfers, and checks.

Investors are urged to check as well the list of Impersonators of Genuine Firms maintained by the SEC and to contact FINRA in case they are suspicious about information received from an individual or firm soliciting business.

Network Security

Network Security

Vulnerability Management

Vulnerability Management

Privileged Access Management

Privileged Access Management

Endpoint Security

Endpoint Security

Threat Hunting

Threat Hunting

Unified Endpoint Management

Unified Endpoint Management

Email & Collaboration Security

Email & Collaboration Security